There are two possibilities: the Obama administration knew for six years that the world’s largest banks were endemically led by frauds or the administration learned of that fact recently when it learned of the results of the FDIC investigation. The LIBOR scandal became public knowledge with the Wall Street Journal’s April 16, 2008 expose, so the Bush administration also knew it was dealing with elite frauds. If the Obama administration has long known that fraud was endemic among the leaders of the world’s largest banks, then its policies toward those CEO and the banks they control have been reprehensible and harmful.

If the administration has just learned from the FDIC investigation about the true nature of the CEOs that it has refused to hold accountable and allowed to retain and even massively increase their wealth through leading control frauds then we can doubtless expect a series of emergency actions transforming the administration’s finance industry policies. The FDIC lawsuit provides a “natural experiment” that allows us to test which of the possibilities was correct

Criminals are on the loose and Politicians are fearful of prosecuting them because they are major campaign donors..Let’s review the bidding. The U.S. government, through the FDIC, has found after a lengthy investigation that the leaders of 16 of the world’s largest banks conspired together to form a cartel to manipulate the LIBOR “numbers” and to defraud the public about the scam. This should have led the criminal justice authorities to prosecute large numbers of senior officers of these banks – but none of them have been prosecuted. It obviously poses a grave threat to the “safety and soundness” of the entire financial system. The endemic frauds led by elite CEOs demonstrate such a pervasive failure of integrity and ethics by the leaders of the finance industry that there is a moral crisis of tragic proportions. So here are some questions (along with the usual who, when, where details) I request that the media formally ask the administration:

- Did the FDIC brief the administration before it brought its LIBOR suit?

- Why didn’t Attorney General Holder and the FDIC leadership conduct a news conference announcing the suit and emphasizing its implications?

- Why didn’t the FDIC’s “home page” or press release site even note the suit?

- Did the suit cause the administration to transform its finance industry policies?

- When will the President address the Nation about fixing the twin emergencies?

I was on the campaign trail for State House this weekend at the 6th Annual Yellow Pollen Street Festival in Hampton, GA. Had a number of great conversations with voters. But one thing that struck me--across the political spectrum there is real anger at the Banks the endemic corruption in Washington DC that puts Wall Street and the big banks before the interests of every day citizens. People are fed up.

Its sad that the people who crashed the economy and destroyed millions of lives are still running amuck with no fear of criminal prosecution. This all reminds me of some comments by Cornel West on how intellectuals have betrayed the poor during the neoliberal era:

The reality is that the "Get Government out of the way" narrative has turned out to be an utter failure. Yet too many Democrats aid Republicans in continuing to push this narrative that has proven to be a failure.

Yves Smith expands on whats wrong with current strain of neolibearl American Capitalism;:

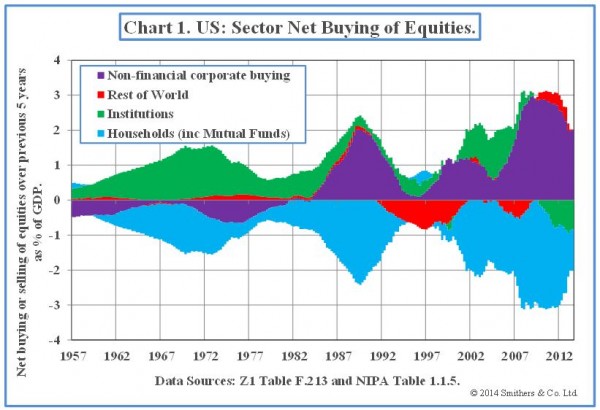

For the last 30 years, neoliberals have fixated on a simple program: “Get government out of the way,” which meant reduce taxes and regulations. Business will invest more, which will produce a higher growth rate and greater prosperity for all. The belief was that unfettered capitalism could solve all ills.Policymakers have dutifully followed this script. Corporations have gotten more and more tax breaks, with the result that the GAO found that their effective Federal tax rate in 2010 was 13% of worldwide income for companies with profits. Corporate income taxes represent a mere 11% of total Federal tax receipts, down from 30% in the mid-1950s. And we’ve also seen substantial deregulation in many sectors of the economy, particularly financial services, transportation, and telecommunications.So have companies lived up to their half of the neoliberal bargain? Take a look at this chart from Andrew Smithers, which was published at the Financial Times. He prepared it to demonstrate how stock market prices have been driven almost entirely by corporate buying. But it serves to make an additional point: that the stock market for a very long time has not served mainly (or lately, much at all) as a vehicle for companies to raise funds to expand their business. Instead, it serves as a machine for manipulating stock prices.Notice that US corporations have been buyers in aggregate since 1985. Now admittedly, that does not mean they stopped investing, since the primary source of investment capital is retained earnings, and companies also typically prefer to borrow rather than issue stock. But as of the 1980s, they were already preferring buying stocks (then mainly of other companies rather than their own, as in acquisitions) to the harder work of expanding their business de novo. Deals are much sexier than building factories or sweating new product launches.But by the mid 2000, companies had indeed shifted to being net savers rather than net borrowers, which was an unheard of behavior in an expansion. That is tantamount to disinvesting. As Rob Parenteau and I wrote in 2010:Unbeknownst to most commentators, corporations in the US and many advanced economies have been underinvesting for some time.The normal state of affairs is for households to save for large purchases, retirement and emergencies, and for businesses to tap those savings via borrowings or equity investments to help fund the expansion of their businesses.But many economies have abandoned that pattern. For instance, IMF and World Bank studies found a reduced reinvestment rate of profits in many Asian nations following the 1998 crisis. Similarly, a 2005 JPMorgan report noted with concern that since 2002, US corporations on average ran a net financial surplus of 1.7 percent of GDP, which contrasted with an average deficit of 1.2 percent of GDP for the preceding forty years. Companies as a whole historically ran fiscal surpluses, meaning in aggregate they saved rather than expanded, in economic downturns, not expansion phases.The big culprit in America is that public companies are obsessed with quarterly earnings. Investing in future growth often reduces profits short term. The enterprise has to spend money, say on additional staff or extra marketing, before any new revenues come in the door. And for bolder initiatives like developing new products, the up front costs can be considerable (marketing research, product design, prototype development, legal expenses associated with patents, lining up contractors). Thus a fall in business investment short circuits a major driver of growth in capitalist economies.....

.....So with large corporations finding it more attractive to game their stock than duke it out in the marketplace, and small companies generally gun-shy in a tepid economy, we have the foundations for the corporate elite to continue looting. Meanwhile, ordinary citizens contend with a hostile job market and have little reason to hope that their financial condition will improve. Welcome to the neoliberal paradise.

Yeah paradise indeed.

Fact is we are 30 years late; but if you'd like to help fight back, chip in a few dollars to my State House campaign. Together we can begin to build a movement willing to fight back.

No comments:

Post a Comment