A federal appeals court Tuesday sided with Georgia in its 20-year-old water war with Alabama and Florida.

In a 95-page ruling, the Atlanta-based U.S. 11th District Court of Appeals overturned a lower court decision handed down nearly two years ago that had threatened to cut off Lake Lanier as metro Atlanta’s primary water source just one year from now.

“The injunction is gone,” said Patricia Barmeyer, a lawyer with King & Spalding LLP who represented Georgia in the case. “There is no more 2012 deadline.”

The appellate court held that U.S. District Judge Paul Magnuson was wrong when he declared in July 2009 that water supply was not an authorized purpose of the federally managed reservoir when Buford Dam was built during the 1950s.

Tuesday’s decision remanded the tri-state water dispute back to the U.S. Army Corps of Engineers, giving the agency one year to make a final determination of its authority to operate the dam.

Magnuson had given the three states three years to work out a water allocation agreement. Absent a settlement, under his order, water withdrawals from Lake Lanier were to be reduced in July 2012 to levels not seen since the mid-1970s.

Georgia has long argued that the reservoir was intended as a water supply.

“This means that the lake will continue to be available to meet Georgia’s needs,” said Brian Robinson, spokesman for Gov. Nathan Deal. “At first glance, it appears that the state of Georgia has won a great victory.”

Lawyers for Florida and Alabama had sought to limit the quantity of water Georgia could retain above Buford Dam, arguing that the two states needed an adequate flow of water down the Chattahoochee River system to protect endangered aquatic species in Florida and for power production purposes in Alabama.

Barmeyer said Tuesday’s ruling means the Corps will now go back and review a water supply request Georgia submitted more than a decade ago. The agency rejected the application at the time, citing its position that water supply was not among the reservoir’s intended purposes.

“[Now], water supply is on a par with hydropower, flood control and navigation,” she said.

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Wednesday, June 29, 2011

Georgia wins tri-state water ruling

Andrew Sheng, Chief Adviser to the China Banking Regulatory Commission

Must watch, Andrew Shend on global sustainability.

Saturday, June 25, 2011

Price, Market Failure, and public policy.

Which says:

"The chemical at the heart of the planet’s most widely used herbicide -- Roundup weedkiller, used in farms and gardens across the U.S. -- is coming under more intense scrutiny following the release of a new report calling for a heightened regulatory response around its use.Critics have argued for decades that glyphosate, the active ingredient in Roundup and other herbicides used around the globe, poses a serious threat to public health. Industry regulators, however, appear to have consistently overlooked their concerns.A comprehensive review of existing data released this month by Earth Open Source, an organization that uses open-source collaboration to advance sustainable food production, suggests that industry regulators in Europe have known for years that glyphosate, originally introduced by American agricultural biotechnology giant Monsanto in 1976, causes birth defects in the embryos of laboratory animals."

"Just for a point of discussion, Do we react by creating a public policy about it and impose regulation to preserve and protect the environment and our health, or do we impose a Libertarian stance?"

I think this is an example of an all too common confusion between political stance and markets. The assumption that being left/right/center leads one to automatically take a stance on the economics involved is flawed. This is an example of a market failure. A big concern for economist--in terms of behaviors that cause price to accurately reflect true cost on the supply/demand curve--is rent seeking and regulatory capture. I don't see this as a Libertarian vs. non-Libertarian choice. The decision to let markets accurately price goods can be found across the political spectrum. Interventions, when market failures are involved--while often imperfect (with needed tweeks because of possible over corrections) isn't dead on arrival for economist. Economists that like to trounce around hiding their political leanings by claiming "economics" will try to play the general public on this but people shouldn't fall for it. Economics says market failures can be corrected. Thats it. Market failures should be corrected via policy when it comes to really important goods/services. In this case market equilibrium of supply and demand is not happening and so price isn't being accurately reflected. When you don't regulate these kinds of poisons you are creating a market failure leading to negative externalities that could be corrected through smart policy and better regulation. Unrestrained selling of poison to ill informed people leads to costs being shifted away from the producer unbeknownst to the buyer of said product. Economists would say market intervention is warranted if people want to allow price to do its handy work. The decision to not intervene in the market in circumstances of market failures are political decisions not economic ones. Having said that the general leanings would probably find that right-libertarians ("Libertarian Party" folks) will defend the individuals right to poison others, left-libertarians like myself, most Democrats and moderate Republicans would say intervene. The recognition of "the right to poison" is nothing more than Ayn Randian pathology from sociopaths and (un-diagnosed) depression in people who either weren't loved as children, or dropped on their heads.

Friday, June 24, 2011

YDG Labor Outreach Committee email list

- Reach out to Labor by getting Young Democrat groups to send a representative to union meetings/events to invite union members to get involved with what local Young Democrat chapters are doing

- Reach out to working class voters who tend to be disaffected, disengaged, and all together distrustful (justifiably so) of either of the two major parties and invite them to get involved with local YD events

- Create a place for Young Democrats who support labor/working class issues to network and learn how to better advocate for labor issues within the Democratic Party (as the Democratic Party has not been a good friend to labor/working class voters for a number of years.)

Thursday, June 23, 2011

recent links on Greek/EU crisis

Greece: Cabinet approves Austerity, European Banks pressured to accept losses

-----

It isn't just the euro by Amartya Sen

Europe's democracy itself is at stake Greece illustrates the danger of allowing rating agencies, despite their abysmal record, to lord it over the political terrain

------

Derivatives Cloud the Possible Fallout From a Greek Default By LOUISE STORY

It’s the $616 billion question: Does the euro crisis have a hidden A.I.G.?

No one seems to be sure, in large part because the world of derivatives is so murky. But the possibility that some company out there may have insured billions of dollars of European debt has added a new tension to the sovereign default debate.

In years past, when financial crises in Argentina and Russia left those countries unable to make good on their government debts, they simply defaulted. But this time around, swaps and other sorts of contracts have become so common and so intertwined in the financial markets that there are fears among regulators and financial players about how a Greek default would play out among derivatives holders.

------

Some Greeks Fear Government Is Selling Nation - NYTimes.com

Reason Magazine: Why is the government doing so little to end sexual assault in prisons

Tuesday, June 21, 2011

Short-term internship during the special session of the Georgia General Assembly

Thursday, June 16, 2011

Cut yourself out of stone...

“I believe that one defines oneself by reinvention. To not be like your parents. To not be like your friends. To be yourself. To cut yourself out of stone.” -- Henry Rollins

Wednesday, June 15, 2011

House Progressives Plan Big Summer Tour To Wrest The Jobs Debate From GOP

America prefers fiscal idiocy to intelligent choices

Please respect FT.com's ts&cs and copyright policy which allow you to: share links; copy content for personal use; & redistribute limited extracts. Email ftsales.support@ft.com to buy additional rights or use this link to reference the article - http://www.ft.com/cms/s/0/c01560e8-952d-11e0-a648-00144feab49a.html#ixzz1PKP7UOAW

Politicians on both sides, seeking to excuse their chronic failure to govern, point to next year’s presidential election as the time to put clear choices to voters about the public spending they want and how they expect to pay for it – and, once and for all, get a ruling. Regardless of whether Barack Obama is re-elected, this will not happen. US elections never settle issues this way: much as the parties may try to deny it, the need for cross-party co-operation, and the muddle and compromise this entails, is built into the constitution. Still, one hoped the presidential race might start a more intelligent discussion of the choices the country has refused to confront up to now.

Anyone entertaining such hopes found last week discouraging. Tim Pawlenty, seen as one of the more serious candidates for the Republican nomination – meaning somebody capable of discussing policy – set out an economic plan, as he called it, that was stunning in its vapidity. The plan is difficult to describe without seeming to parody it. I will do my best.

What the US most needs, Mr Pawlenty said, is a target for economic growth. Up to now, you see, lack of ambition has been the problem. Let this target be, oh, 5 per cent a year. Now see what growth of 5 per cent a year for 10 years – yes, 10 years – would do. The deficits just melt away. And there would be millions of new jobs.

This solves the fiscal problem and puts the economy back to work, but one cannot stop there. The size of government, a problem in its own right, would still need to be reduced. Therefore, let there be a constitutional amendment to cap public spending at 18 per cent of gross domestic product – six percentage points of GDP below its current level, and well below the average of recent decades. That way, demographic pressures on Social Security and Medicare would be unconstitutional, and hence contained.

This reduces the pressure on taxes, so Mr Pawlenty can take the Republican refusal to countenance increases of any kind and square it. Rates of income tax will come down; personal tax exemptions will remain (no need to widen the tax base); and taxes on capital gains, dividends and interest will be abolished altogether. It all adds up because the economy will growing at 5 per cent a year.

One hopes that Mr Pawlenty, in proposing this idiotic farrago, is making a cynical tactical calculation: win over the Tea Party activists by outflanking everyone on the right – difficult as that may be – then come back to the centre once the nomination is won. But having put down markers such as these, travelling all the way back to the land of the sane may be impossible. In any event, if you hoped that the presidential contest might raise the quality of discussion about US fiscal options, read Mr Pawlenty’s speech and weep.

One way or another, the US is finally going to collide with fiscal reality. There need not be a crisis: deals might yet be cut to make this collision less violent. What seems ever less likely, though, is that the country’s politicians will frame intelligent choices to put before voters, or that voters will insist that they do.

Time for the Administration to Pivot to More Stimulus

So say we all!!

For example, here: http://www.ft.com/intl/cms/s/0/b3c143b6-952d-11e0-a648-00144feab49a.html#axzz1P7M3EyCp The thinking of Lawrence Summers:

[The] US is now halfway to a lost economic decade. In the past five years, our economy’s growth rate averaged less than one per cent a year... the fraction of the population working has fallen from 63.1 per cent to 58.4 per cent.... [An] economy producing below its potential for a prolonged interval sacrifices its future. To an extent once unimaginable, new college graduates are moving back in with their parents. Strapped school districts across the country are cutting out advanced courses in maths and science. Reduced income and tax collections are the most critical cause of unacceptable budget deficits now and in the future....

That the problem... is a lack of business demand for employees not any lack of desire to work is all but self-evident... the propensity of workers to quit jobs and the level of job openings are at near-record lows; rises in non-employment have taken place among all demographic groups; rising rates of profit and falling rates of wage growth suggest employers, not workers, have the power in almost every market.

A sick economy constrained by demand works very differently from a normal one.... When demand is constraining an economy, there is little to be gained from increasing potential supply... if more people seek to borrow less or save more there is reduced demand, hence fewer jobs.... After bubbles burst there is no pent-up desire to invest. Instead there is a glut of capital... consumers discover they have less wealth than they expected, less collateral to borrow against and are under more pressure than they expected from their creditors. Pressure on private spending is enhanced by structural changes....

What, then, is to be done?... The central irony of financial crisis is that while it is caused by too much confidence, borrowing and lending, and spending, it is only resolved by increases in confidence, borrowing and lending, and spending. Unless and until this is done other policies, no matter how apparently appealing or effective in normal times, will be futile at best. The fiscal debate must accept that the greatest threat to our creditworthiness is a sustained period of slow growth. Discussions about medium-term austerity need to be coupled with a focus on near-term growth. Without the payroll tax cuts and unemployment insurance negotiated last autumn we might now be looking at the possibility of a double dip. Substantial withdrawal of fiscal stimulus at the end of 2011 would be premature. Stimulus should be continued and indeed expanded.... [It] is a false economy to defer infrastructure maintenance and replacement, and [not to] take advantage of a moment when 10-year interest rates are below 3 per cent and construction unemployment approaches 20 per cent to expand infrastructure investment. It is far too soon for financial policy to shift towards preventing future bubbles and possible inflation, and away from assuring adequate demand...

So say we all, that is, except for the White House: http://www.economist.com/blogs/freeexchange/2011/06/fiscal-policy-0 The thinking of the Obama administration, as reported by Ryan Avent:

Whether or not the move toward [immediate] austerity was heartfelt, the administration has now embraced the policy choice. At a White House forum on the economy yesterday, I heard from several administration officials who defended the present policy path in no uncertain terms. Austan Goolsbee, outgoing chairman of the Council of Economic Advisers, played down the May employment figure as just one data point and touted administration efforts to support entrepreneurship and facilitate private investment. I asked him whether his comments could be taken as indicating that the administration no longer felt fiscal stimulus could or should be used to support aggregate demand. Not at all, he replied, before talking more about the investment incentives and regulatory initiatives the White House has supported. These were, almost exclusively, supply-side policies. The administration's business-support efforts look like useful steps to me, but they're clearly not designed to provide a direct boost to aggregate demand. The time for that has passed, or so Mr Goolsbee seemed to imply.

The comments from Gene Sperling, Director of the National Economic Council and a key member of the team negotiating an agreement on an increase in the debt ceiling, were clearer still. The White House believes, he said, that deficit-cutting is an important component (the emphasis was his) of a growth strategy. And he repeatedly said that deficit-reduction was crucial in generating economic confidence. Confidence—he repeated this word many times...

Tuesday, June 14, 2011

Yet another illegal war -- now in Yemen

Inept Obama “Anybody but Warren” Stance Reveals Fundamental Bank v. Middle Class Fault Line

Reality has a liberal bias

Republican fake claims that the stimulus was too large: Rebutted by former Reagan CEA ChairMartin Feldstein: "As for the "stimulus" package, both its size and structure were inadequate to offset the enormous decline in aggregate demand. The fall in household wealth by the end of 2008 reduced the annual level of consumer spending by more than $500 billion. The drop in home building subtracted another $200 billion from GDP. The total GDP shortfall was therefore more than $700 billion. The Obama stimulus package that started at less than $300 billion in 2009 and reached a maximum of $400 billion in 2010 wouldn't have been big enough to fill the $700 billion annual GDP gap even if every dollar of the stimulus raised GDP by a dollar.... Experience shows that the most cost-effective form of temporary fiscal stimulus is direct government spending.... President Obama allowed the Democratic leadership in Congress to design a hodgepodge package of transfers to state and local governments, increased transfers to individuals, temporary tax cuts for lower-income taxpayers, etc. So we got a bigger deficit without economic growth..."

Tim Pawlenty's fake claim that tax cuts almost always raise revenue: Rebutted by former Jack Kemp aide Bruce Bartlett: "During the George W. Bush years, however, I think SSE became distorted into something that is, frankly, nuts--the ideas that there is no economic problem that cannot be cured with more and bigger tax cuts, that all tax cuts are equally beneficial, and that all tax cuts raise revenue. These incorrect ideas led to the enactment of many tax cuts that had no meaningful effect on economic performance. Many were just give-aways to favored Republican constituencies, little different, substantively, from government spending. What, after all, is the difference between a direct spending program and a refundable tax credit? Nothing, really, except that Republicans oppose the first because it represents Big Government while they support the latter because it is a "tax cut." I think these sorts of semantic differences cloud economic decisionmaking rather than contributing to it..."

Republican fake claims that Medicare is the inefficient and wasteful part of the American health care system: Rebutted by Ezra Klein: "It is quite a bit less expensive than private insurance.... What’s odd about Medicare, however, is that it’s also a lot more expensive than... the Veterans Administration or Medicaid... than Canada’s health-care system... or than Britain’s or Germany’s or France’s.... Maybe our government is, for various reasons, simply much less willing to squeeze providers and drug and device manufacturers. Note that when Republicans passed the 2003 Medicare Prescription Drug Benefit, they prohibited Medicare from negotiating any discounts on drug prices whatsoever, and though Democrats furiously opposed that rule, they couldn’t muster the votes to overturn it during health-care reform. Nevertheless, this means that the closest thing to a surefire way to cut costs into Medicare is to make it bigger, which in turn gives it more clout. Letting adults between 55 and 65 buy into the program would’ve helped with that, though probably not so much that it would’ve made a difference. A public option that partnered with Medicare for bargaining purposes and was open to everyone would’ve been more of a gamechanger..."

Fake McKinsey claims that one-third of employers will drop employer-sponsored health insurance because of the PPACA: Rebutted by anonymous McKinsey analysts: "A McKinsey spokesperson... [said] that, for the moment, McKinsey will let the study speak for itself. However, McKinsey notes that the survey is only one indicator of employers' potential future actions.... The three authors of the report were not immediately available for comment. Another keyed-in source says McKinsey is unlikely to release the survey materials because "it would be damaging to them." Both sources disagree with the results of the survey, which was devised by consultants without particular expertise in this area, not by the firm's health experts..."

Tim Pawlenty used to be in favor of health-care mandates: Former Pawlenty staffer Paul Ludeman says: "Minnesota’s exchange proposal would have required all employers with more than 10 employees to create a “section 125 plan” so workers could buy cheaper insurance with pre-tax dollars. During a 2007 news conference, Pawlenty said launching such a system would only cost employers about $300..."

RERUN: Republican claims that cutting the deficit now is the key to recovery: Lawrence Summers:"[T]he greatest threat to our creditworthiness is a sustained period of slow growth. Discussions about medium-term austerity need to be coupled with a focus on near-term growth. Without the payroll tax cuts and unemployment insurance negotiated last autumn we might now be looking at the possibility of a double dip. Substantial withdrawal of fiscal stimulus at the end of 2011 would be premature. Stimulus should be continued and indeed expanded..."

RERUN: Fake Republican claims that discretionary spending has risen by 80% under Obama:Paul Krugman: "Politifact has now updated its work on the claim, universal on the right — and repeated often by Paul Ryan — that discretionary non-defense spending is up 80 percent under Obama. It’s completely false. As anyone who knows how to read federal statistics should have known, the real number — including the stimulus — is 26 percent. And it’s now in the process of falling off. The discretionary spending falsehood is a key part of the claim that Obama has presided over a vast expansion of government; as I’ve tried to explain, the only real area of rapid growth has been in safety net programs that spend more when there is high unemployment..."

RERUN: Douglas Holtz-Eakin's claim that it would be better to default than to pass a clean increase in the debt ceiling: [Rebutted by] Douglas Holtz-Eakin, a top Republican advisor and former CBO director, [who] warned in a panel discussion this week that creditors would not be easily reassured after a default: "The idea that somehow it's a pro-growth strategy to raise interest rates on a permanent basis in the United States is just crazy," he said. "We need to grow at this point more than anything else."

RERUN: Republican claims that we need big federal spending cuts now: Jeanne Sahadi talks to the real--rather than the phony Republican--deficit hawks: "Federal Reserve Chairman Ben Bernanke. 'A sharp fiscal consolidation focused on the very near term could be self-defeating if it were to undercut the still-fragile recovery.'... 'The short-term deficit isn't the problem', said former U.S. Comptroller David Walker.... Walker... thinks lawmakers should consider spending several hundred billion dollars in the short-run to make strategic investments in areas such as surface transportation, alternative energy and research and development.... Alice Rivlin... 'if you just slash spending now or if you raise taxes right now -- that's a very bad thing to do as the economy is beginning to strengthen'. Rivlin would prefer if lawmakers offer additional aid to state and local governments to prevent more layoffs.... Ken Rogoff.... 'The important thing to do is structural reform. Make us grow faster. Improve our tax system, build infrastructure, education, view it as a crisis in that way.... I certainly don't think slashing budgets at some last-minute deal is the way to go about business.'"

RERUN: Tax cuts will speed economic growth: Paul Krugman: "CBPP reminds us that the Bush tax cuts totally failed to deliver, even before the financial collapse.... [T]he story is even worse for believers in tax-cut magic if you include the Clinton years; some of us remember the confident predictions that the 1993 tax hike would lead to a catastrophic recession. You might have thought that an ideology that failed so dramatically would have been to at least some extent abandoned. But noooo: belief in tax-cut magic is central to the Ryan plan, and aspiring GOP candidates like Pawlenty seem to be in a race to see who can go more overboard in supply-side faith. Oh, and if you don’t believe their claims, you don’t trust the American people. What will it take before the GOP drops voodoo as its official religion?"

RERUN: Republican claims that Peter Diamond is unqualified to be on the Federal Reserve: Clive Crook: "Peter Diamond's decision to withdraw from contention for a seat on the Fed board is a very low moment in US politics. Diamond is an indisputably brilliant economist with no ideological baggage and highly relevant expertise--contrary to what his GOP critics say, and as he explains in his NYT article. It ought to be shocking, but it no longer is, that a man of his distinction could not get confirmed to the position. At times the US seems a country hell-bent on its own failure."

RERUN: "Deficit-Hawk Paul Ryan": Jonathan Chait: "Stop calling Ryan a "deficit hawk." He voted for all of Bush's tax cuts. He voted for all the wars. He voted for Bush's Medicare prescription drug bill. He voted against the deficit-reducing Affordable Care Act. He voted against the Bowles-Simpson plan. He opposes any deficit reduction plan that increases revenue. Ryan is anti-government but he is clearly not a deficit hawk..."

RERUN: Mitt Romney's claim that we are only inches away from ceasing to be a free market economy:Buce: "[W]hen Mitt Romney says that we are 'only inches away from ceasing to be a free market economy', you'd just have to write it up as an arrogant, insolent, baldfaced lie. Which is pretty much what they are calling it over at Politifact, the Poynter journalistic fact-checker (sourced, ironically, in large measure, to those bomb-throwing insurrectionists at the Heritage Foundation).... [T]he US ranks ninth from the top "freest") out of 179.... None of this is surprising to anyone of even mildly wonky sentiments, a group which clearly includes Romney himself. But here's an extra irony I hadn't noticed before: health care. Namely that every one of those top eight has some kind of universal public health care. And they virtually all get better results than the US has, and at substantially less cost.... I dunno, maybe Romney (who can clearly say anything with the same schoolboy grin) will soon be telling us that Singapore and Hong Kong (and Switzerland, and Denmark, and Canada, and Ireland, and New Zealand, and Australia) are just mired in post-Leninist purgatory. Others might say otherwise: they might say it shows that freedom can be enhanced (ev

US and Afghanistan talks could see troops stay for decades

American and Afghan officials are locked in increasingly acrimonious secret talks about a long-term security agreement which is likely to see US troops, spies and air power based in the troubled country for decades. Though not publicised, negotiations have been under way for more than a month to secure a strategic partnership agreement which would include an American presence beyond the end of 2014 -- the agreed date for all 130 000 combat troops to leave -- despite continuing public debate in Washington and among other members of the 49-nation coalition fighting in Afghanistan about the speed of the drawdown. American officials admit that although Hillary Clinton, the US secretary of state, recently said Washington did not want any "permanent" bases in Afghanistan, her phrasing allows a variety of possible arrangements....... .....There are at least five bases in Afghanistan which are likely candidates to house large contingents of American special forces, intelligence operatives, surveillance equipment and military hardware post-2014. In the heart of one of the most unstable regions in the world and close to the borders of Pakistan, Iran and China, as well as to central Asia and the Persian Gulf, the bases would constitute rare strategic assets.News of the US-Afghan talks has sparked deep concern among powers in the region and beyond. Russia and India are understood to have made their concerns about a long-term US presence known to both Washington and Kabul. China, which has pursued a policy of strict non-intervention beyond economic affairs in Afghanistan, has also made its disquiet clear. During a recent visit, senior Pakistani officials were reported to have tried to convince their Afghan counterparts to look to China as a strategic partner, not the US.............. The US want to have agreement by early summer, before President Barack Obama's expected announcement on troop withdrawals. This is "simply not possible," the Afghan official said. There are concerns too that concluding a strategic partnership agreement could also clash with efforts to find an inclusive political settlement to end the conflict with the Taliban. A "series of conversations" with senior insurgent figures are under way, one Afghan minister has told the Guardian. A European diplomat in Kabual said: "It is difficult to imagine the Taliban being happy with US bases [in Afghanistan] for the foreseeable future."Senior Nato officials argue that a permanent international military presence will demonstrate to insurgents that the west is not going to abandon Afghanistan and encourage them to talk rather than fight. The Afghan-American negotiations come amid a scramble among regional powers to be positioned for what senior US officers are now describing as the "out years".Mark Sedwill, the Nato senior civilian representative in Afghanistan, recently spoke of the threat of a "Great Game 3.0" in the region, referring to the bloody and destabilising conflict between Russia, Britain and others in south west Asia in the 19th century. Afghanistan has a history of being exploited by -- or playing off -- major powers. This, Dr Ghani insisted, was not "a vision for the 21st century". Instead, he said, Afghanistan could become the "economic roundabout" of Asia.

Sunday, June 12, 2011

Deficits More Than Pay for Themselves

The old "tax cuts pay for themselves" justification for cutting the tax rates of the wealthy is back:

despite a host of Republican economists telling them otherwise, Republican policymakers can’t resist arguing that tax cuts pay for themselves. That’s the old voodoo economics.

There's no evidence that tax rates have ever come close to paying for themselves at tax rates such as the US imposes, so it's a justification without merit. In fact, there's no evidence that the Bush tax cuts had any effect on growth at all (see here too). The claim that tax cuts are self-financing is snake oil, and if the press was doing its job any politician saying this would immediately be labeled as a fraud (Ryan's budget proposal makes this claim). Yet it lives on.

Just for fun, did you know that deficits more than pay for themselves?

Suppose the nation needs a key piece of infrastructure, a public good the private sector has trouble providing for itself. If the government puts the infrastructure into place through deficit spending, it will increase private sector growth for as long as the infrastructure remains in place, i.e. until it wears out (it could be replaced, but I want to focus on a single project). If the extra tax revenue from the higher economic growth rate covers maintenance costs, the cost of the project, and then some, then the project more than pays for itself. It won't cost taxpayers a dime. In fact, it will save them money.

The problem, of course, is that just as in the private sector it is very unlikely that the economic growth rate would increase enough to actually generate sufficient revenues to cover the costs - it would take a substantial increase in economic growth to do that (into the Pawlenty zone of infeasibility).

Let me emphasize that this says nothing about whether a project benefits society. The tax revenue a project generates through increased growth is different from the economic benefits of a project. In some cases there is little relationship between revenue and benefits, so whether a project generates sufficient tax revenue to pay for itself says nothing about whether it is worthwhile to society. That's not a test of private sector projects -- the requirement is simply that the benefits exceed the costs -- and the same is true for public sector projects. For example, providing public parks may not do much for growth, and they may generate little if any revenue, but they can still be a net positive when willingness to pay for parks is compared to the actual taxes that are collected.

A broader point here is that tax cut proponents often point to the private sector benefits of a tax cut, the increased growth, tax revenue, employment, trickle down benefits, etc. that supposedly occur. But they rarely look at what is lost from cutting public spending to pay for the tax cut (or, if spending isn't cut, the costs of the deficit that is created -- deficits Republicans profess to fear so much due to their very high costs). If what is lost in the public sector from cutting spending (or from creating a long-term budget problem) is more than what is gained in the private sector, then even though it may be possible to point to private sector gains, overall the tax cut was harmful.

I'm not arguing that every cut in taxes and spending would result in a net loss to society. There are certainly areas where government spending could be cut (and other areas, like health care, where we could get net positive returns from expansion). But we should at least consider what we give up when we cut spending (or increase the deficit) to pay for tax cuts, something those who argue for tax cuts as the solution to any and all of the nation's economic problems rarely rarely do. If, for example, the cost is important social programs or key pieces of infrastructure, then society may very well end up worse off.

Doug Henwood: Lots of fresh audio product

Four shows newly posted to my radio archives:

June 11, 2011 Vincent Reinhartat the Council on Foreign Relations on Greece and the political trick of austerity (thanks to the CFR for allowing broadcast; full event here) •Greg Grandin, author of Fordlandia, on all the great political developments in South America

June 4, 2011 Another Hoover interview: Morris Fiorina on American public opinion and the nonexistence of the “culture war” • And in non-Hoover content, Yanis Varoufakis updates the Greek and EU crises

May 28, 2011 Hoover Institution special. Two interviews from my week as a Hoover media fellow. Paul Gregory on Russian politics (Putin vs. Medvedev) •Terry Moe on school “reform” (i.e., charters, testing, unionbusting, etc.)

May 14, 2011 Deepa Kumar, author of this article, on political Islam [The last 20 minutes of the broadcast version of this show was devoted to fundraising for KPFA. This has been excised for the web version. But if you like what you hear, please donate.]

And now the show has a new Facebook page: Behind the News, with Doug Henwood.

Department of "Ahem!": Unemployment Edition

Back a month or so ago, at Stanford, Christina Romer said:

Zale Lecture: Let me start with continued high unemployment. This has obviously been a terrible recession. The collapse of the housing bubble and the resulting financial crisis set in motion a horrible decline in spending and employment. Problem. The past two and a half years have been simply wretched for many American families. At its worst, employment was down some 81⁄2 million from its peak. Unemployment hit 10.1%. This truly has been the worst recession in the United States since the Great Depression. Now we started growing again the third quarter of 2009. Employment started expanding about a year later. So far, we have added about 1.5 million jobs. And the unemployment rate has fallen just over a percentage point. That is certainly an improvement, but it is not nearly good enough. The unemployment rate is still 8.8%. More than 13 million Americans are without a job. Six million of them have been out of work for more than six months...

Count me as unimpressed with falls in the unemployment rate 100% of which are declines in labor force participation, and 0% of which are the result of increases in the employment-to-population ratio...

Are All Labor Market Matching Problems Structural?

I had a radio interview not too long ago on cyclical versus structural unemployment, and in rereading some old posts on the topic I came across this statement from Brad DeLong:

Let us remember what structural unemployment looks like. The economy is depressed and unemployment is high not because of slack aggregate demand generated by a collapse in spending, but instead because “structural” factors have produced a mismatch between the skills of the labor force and the distribution of demand.

That reminded me of a point I've been meaning to make. With all the talk about whether our unemployment problem is cyclical or structural (it's mostly cyclical), many people are looking at measures of mismatches to assess how much of the problem is structural. But care needs to be taken in the interpretation of mismatch numbers. Here's why.

Suppose that you run a business in Town A and you need someone to run a complicated piece of equipment. Unfortunately, the size of your town is relatively moderate, and there are no qualified job applicants available. You have advertised the job for weeks, but no takers. This sounds like a classic case of structural unemployment -- there is a need for workers with a different skill set -- but it may not be a structural problem.

Suppose also that the economy is in a recession, and business has not been good. Because of that, you can't offer a very high wage. It turns out that in the very next town, Town B, there is a qualified worker who was laid off due to a business failure caused by the recession, but at the wage you are offering the worker is not willing to move. The worker has a job and is surviving, though the pay is much less than before and the worker is underemployed -- the worker is mismatched -- but the family is getting by.

However, if things were better -- if the economy was humming away at full employment -- the employer in Town A could offer a higher wage and induce the worker in Town B to move. If so, then this unemployment is cyclical, not structural. There is a mismatch, but the mismatch is driven by lack of demand.

The point is that when we talk about structural unemployment, we assume aggregate demand is not the problem. Thus, structural unemployment must be measured under an assumption that demand is sufficient to return us to full employment. Structural unemployment is driven by changes in tastes, technology, etc. that produce geographic, skill, or other mismatches that prevent reemployment. For example, if there is a change in tastes that causes the demand for hula hoops to fall and the demand for skateboards to increase, or a change in technology that causes the demand for typewriters to fall and the demand for word processing software to increase, then we have to move workers and other resources out of hula hoop and typewriter production and into the skateboard and word processing businesses. That will take time if there are geographic, training, or other barriers that prevent the quick translation of resources from one use or one place to another. Note, however, that the problem is not lack of demand. People want more skateboards and word processors than they currently have, so that unlike the example above where higher demand and the higher wages that come with it cause the worker to move and eliminate the mismatch, an increase in demand won't fix the problem. If an increase in demand will fix the problem, as in the example above, then it's not a structural problem.

The bottom line is that to measure structural unemployment in a recession, it's not enough to simply survey the labor market and count the mismatches. You have to know if those mismatches would persist at a level of demand consistent with full employment. To the extent that the mismatch problem is due to lack of demand, and wages and prices that are too low to induce resource movements to their best use, the problem is cyclical, not structural.

Reversing the Great Risk Shift: Federally Funded, Income-Linked Student Loans?

In recent, years, the U.S. has undergone what political scientist Jacob Hacker calls “The Great Risk Shift“. Hacker explains this concept succinctly on his website as follows:

For decades, Americans grew both steadily richer and steadily more secure. They received health and retirement benefits and stable jobs from employers. Social Security, Medicare, and other public programs stepped in when employers would or could not. But over the last generation, this public-private framework of security has unraveled, leaving Americans newly exposed to the harshest risks of our turbulent economy: losing a good job, losing health care, losing retirement savings, losing a home—in short, losing a stable financial footing. Increasingly, Americans find themselves on a financial tightrope, without a safety net if they slip. Bankruptcy rates are skyrocketing, and more people don’t have health insurance or secure retirement benefits. Meanwhile, family incomes fluctuate up and down three times as violently today as they did in the early 1970s. At bottom, what my research shows is simple and frightening: Families are now facing up and down swings that rival the most volatile stocks.

To summarize, American institutions have increasingly put the risk on individuals, and off of large corporations or the state. The clearest example of this sort of risk shift might be trends in retirement accounts. In the mid-20th century, in addition to social security, many Americans paid into “defined benefit” pensions. These pensions were guaranteed to provide a certain amount of income upon retirement. In the last few decades, employers have shifted away from these pensions and towards “defined contribution” accounts, where employees are guaranteed nothing except some tax benefits and perhaps matching contributions. In other words, employees, not employers, now bear the risks of stock market fluctuations and the like.* Similarly, health care plans increasingly cover only a fraction of health care costs (e.g. 70%) and thus require people to pay substantial portions of their (highly variable) health care costs, a pretty straightforward example of “risk shift”. One year, you might owe nothing. Another year, you might owe tens of thousands of dollars and be forced into bankruptcy. Having health insurance no longer shields you from as much of the risk of unexpected health care costs as it used to.

These trends are disturbing, but they also present an opportunity or method for rethinking our social institutions. We can ask, how can we shift risks back onto larger institutions more capable of handling them? Hacker has focused a lot of attention on retirement, unemployment and health care costs, which are logical and hugely important places to start. But we can also extend the same logic into other arenas. Think, for example, of student loans.

Student loans are a big topic of conversation, at least among academics, as they are one of the causes and consequences of the rising cost of college. For-profit educational institutions, like the University of Phoenix, feed off of student loans (without necessarily providing much in return), while more traditional universities rely on student loans to help cover their increasing costs.** Student loan debt is difficult if not impossible to get rid of in bankruptcy, and for students who fail to get high paying jobs can present a serious financial burden, especially unsubsidized private loans. One solution to this problem, so far with only limited uptake, are so-called “human capital contracts”. The NYT had a short piece on the topic: Instead of Student Loans, Investing in Futures. The piece discusses a small private company called Lumni which has so far provided financing to about 1900 students in the US and Latin America along these lines:

Sneider’s dream was to attend college so he could become a nurse and serve his community. To do so, he needed $8,500 — a sum that is close to the average annual income in Colombia. … Here’s the deal that Lumni struck with him: In exchange for $8,530 in financing, Sneider agreed to repay 14 percent of his salary for 118 months after he graduated. At that point, regardless of how much he has paid, his obligation terminates.

So instead of agreeing to repay a fixed amount, Sneider agrees to pay a fixed percentage of his income. For Lumni, the loan still rates to be profitable – much like an insurance system, as long as most loan-recipients end up with decent jobs, Lumni has priced the agreements so that it comes out ahead. If there’s a big recession, on the other hand, and many graduates can’t find decent jobs (like, oh.. the past three years) Lumni would lose money but the individuals themselves would still be above water (or at least not worrying about missing a loan payment in addition to everything else). Lumni bears the risk:

What this means is that the students who have the biggest problems benefit the most. And, in effect, those who decide to become investment bankers end up subsidizing the ones who decide to become social workers. Since a good society needs many different roles fulfilled, everyone benefits.

In other words, you run the great risk shift backwards. But here’s the thing, Lumni is a small private company which can only extend loans to a handful of people. And it faces regulatory and enforcement issues – how do you tell how much money someone makes? Etc. On the other hand, the federal government is already deeply enmeshed in the student loan business, and the figuring-out-how-much-you-make-and-taking-part-of-it business (i.e. federal income tax). So why not have the federal government offer such programs? Offer students a deal: we pay your tuition, you agree to pay a higher tax rate when you graduate. If you graduate, and become a social worker and make $30k/year, it costs you very little. If you get a job on Wall St. and rake in the big bucks, you pay a bit more. If there’s a big recession and graduates can’t find jobs, the government takes a hit but the graduates have less to worry about. If there’s a boom, the government makes a bit more than planned. Income-linked student loans (we really need a catchy name) would provide a way for the government to assume more of the risk of student loans, while still expecting to make a small profit (or break even), but in a countercyclical fashion. And because the federal government already has extensive experience and bureaucracy set up for administering loans, and for collecting taxes, it wouldn’t require a giant institutional leap to implement.***

If nothing else, income-linked, federally funded (or not) student loans provide a nice example of a policy that explicitly seeks to reverse the great risk shift.

* Recent UM B-School PhD Adam Cobb is doing interesting work on this history.

** There has been a ton of discussion of these topics all across the media and internet, from the Chronicle of Higher Education to the New York Times. I highly recommend OrgTheory’s discussion of these topics as one entry point.

*** This statement may be more than a little optimistic. No program is ever simple to implement. But at least it’s plausible this one could be relatively feasible.

Saturday, June 11, 2011

Wage growth slows to a crawl

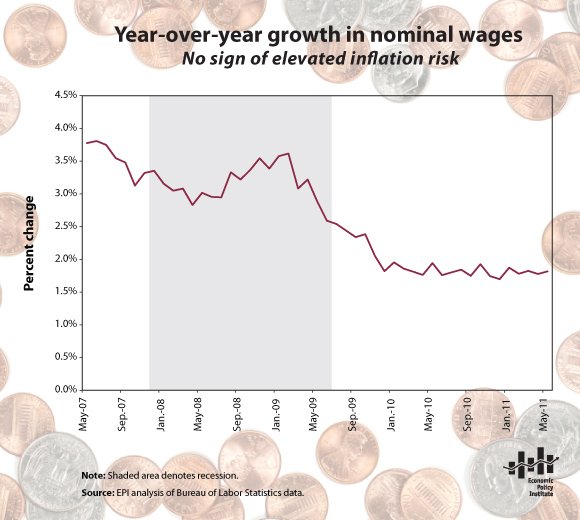

Unemployment remained high at a rate of 9.1% in May 2011, but that is only one of many problems facing the labor market. In addition to this stubbornly high unemployment rate, wage growth has tumbled in the recession and its aftermath, falling from an annual growth rate of 3.8% in May 2007 to a rate of 1.8% in May 2011. Average hourly wages were relatively flat in May (up 6 cents), a rate that has been treading water over the last year and which is far worse than before the recession started (see chart). As for the concerns of inflation hawks, the trend in wage growth provides absolutely no cause for alarm.

Friday, June 10, 2011

Morning links... 6.10.2011

"In their effort to prove that everything is possible, totalitarian regimes have discovered without knowing it that there are crimes which men can neither punish nor forgive." --Hannah Arendt

Hannah Arendt: Total Domination

Hannah Arendt Summary of Total Domination.

A prerequisite of total domination of someone was destroying a persons “rights” as a man, “killing the juridicial person in him”(p. 581). Next the “moral person” in man had to be eliminated, “[t]hrough the creation of conditions under which conscience ceases to be adequate” and the ability to do good becomes impossible (583). Finally, an individuals unique identity must be destroyed, transforming them into, “a specimen of animal,”—merely organic compounds of flesh. By destroying individuality “mans power to bring something new out of his own resources,” is removed from the equation thus solidifying the totalitarian regime by taking what were once human beings who lived lives at odds with the belief that everything is or should be possible; turning human beings into “marionettes with human faces” (586).

Arendt believed that the concentration and extermination camps were the most essential institution of a totalitarian regime because they solidified the regimes power by removing the single biggest threat to its existence—the spontaneity of individuals; transforming human nature itself proving that everything is possible, even crimes “which man can neither punish nor forgive. (591).”

Anthony Weiner’s Constituents Don’t Want Him To Resign

Health reform: One way capitalism can make health care worse and more expensive

Wednesday, June 8, 2011

Morning links... 6.8.11

When You Don’t Need To Worry About Facts « The Baseline Scenario:Humans are not proud of their ancestors, and rarely invite them round to dinner. --Douglas Adams

Many Atlanta area hospitals not adequately serving non-English speakers

Many Georgia hospitals aren’t doing enough to ensure accessibility for non-English speakers, according to a report (pdf) released this week by Georgia Watch’s Hospital Accountability Project. Most hospitals throughout the state are required to follow basic language accessibility regulations set forth by Title V1 of the Civil Rights Act, the Affordable Care Act, and the Indigent Care Trust Fund.

But too many are doing the bare minimum to lower barriers for those with limited English proficiency, if anything at all. In a recent survey of more than 90 Georgia hospital websites, only about one-sixth had information on available financial aid programs in a language other than English and Spanish. In diverse communities, such as DeKalb and Gwinnett counties, many languages are common, such as Chinese, Vietnamese and Burmese.

Tuesday, June 7, 2011

The trucks won't load themselves... morning links 6.7.11

Sunday, June 5, 2011

Non-libertarianism of classical liberalism

Thomas Jefferson is not my favorite among the founding fathers, but this 1785 letter to James Madison quoted by Daniel Kuehn is another good example of the non-libertarianism of classical liberalism:

Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise. Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right. The earth is given as a common stock for man to labour and live on. If, for the encouragement of industry we allow it to be appropriated, we must take care that other employment be furnished to those excluded from the appropriation. If we do not the fundamental right to labour the earth returns to the unemployed. It is too soon yet in our country to say that every man who cannot find employment but who can find uncultivated land, shall be at liberty to cultivate it, paying a moderate rent. But it is not too soon to provide by every possible means that as few as possible shall be without a little portion of land. The small landholders are the most precious part of a state.

As with John Locke you see this concern about concentrated appropriation of finite resources. In practical terms, Jefferson and other leaders of the early Republic were able to sidestep inequality within the white community by redistributing land from Native Americans to white people.

What was Hayek's goal?

3.After having looked long enough between the philosopher's lines and fingers, I say to myself: by far the greater part of conscious thinking must still be included among instinctive activities, and that goes even for philosophical thinking. We have to relearn here, as one has had to relearn about heredity and what is "innate." As the act of birth deserves no consideration in the whole process and procedure of heredity, so "being conscious" is not in any decisive sense the opposite of what is instinctive: most of the conscious thinking of a philosopher is secretly guided and forced into certain channels by his instincts.Behind all logic and its seeming sovereignty of movement, too, there stand valuations or, more clearly, physiological demands for the preservation of a certain type of life. For example, that the definite should be worth more than the indefinite, and mere appearance worth less than "truth" - such estimates might be, in spite of their regulative importance for us, nevertheless mere foreground estimates, a certain kind of niaiserie which may be necessary for the preservation of just such beings as we are. Supposing, that is, that not just man is the "measure of things."

Liberty and the authority of the boot-maker...

I note that the West increasingly has the inverse of the traditional Chinese view of intellectual authority. On many subjects—climate change, for example—we think the views of the vast mass of the people count for more than the weight of scientific opinion. Authority counts for almost nothing.He agrees. "That's actually a big problem in Western public administration because I think good governance is a kind of aristocratic phenomenon. And, we don't like deference to experts and we don't like delegating authority to experts. Therefore, we ring them around with all of these rules, which limit their discretion, because we don't trust them. The disease has gone furthest in the United States." His view seems to be that the world is caught between too little democracy in the East and too much in the West.

Matthew Yglesias makes the essential and too-rarely made point that the classical liberals--the liberals of the Enlightenment--Locke and company down through Mill--were not theorists of "negative liberty" or "libertarians" but rather had a balanced viewpoint. For them, both negative and positive liberty were important: freedom from constraint and freedom to do things to pursue your happiness. Liberty and capability--much like modern liberals, who think that one thing civil society owes us is access out of the immense storehouse of human wealth piled up over past generations to a reasonable quantum of the resources we need to pursue happiness. We are the children of Locke and Mill--not those weirdoes out there on their seasteading oil platforms.

Matthew Yglesias:

An idiosyncratic intellectual project of mine is trying to rescue classical liberalism’s good name from the clutches of contemporary libertarianism. A big issue here is that classical liberals were very concerned with binding resource constraints. In their day, that meant primarily arable land. John Locke, for example, famously noted that individual appropriation of land as property was legitimate “at least where there is enough, and as good, left in common for others.”

The particular problem of arable land isn’t a big deal in a modern rich democracy. But the basic issue that individualistic solutions don’t work when you have binding resource constraints is applicable to a lot of modern day issues. The atmosphere has a finite ability to absorb carbon dioxide emissions before we hit some kind of devastating climate tipping point. It’s striking that seven of the world’s ten highest revenue firms are in the oil business. And a huge share of the recent action in the high-tech space is intimately bound up with the finite quantity of radio spectrum. Tim Lee, who identifies as a libertarian but who I see eye to eye with a huge range of issues, has a thoughtful post about the application of these Lockean issues to the AT&T/T-Mobile merger.

Meanwhile, for the countervailing forces ledger note that the Communications Workers of America are strong proponents of the merger because AT&T is unionized and they think this will help them organize T-Mobile’s workers.