nobody has an obligation to be interested in any particular frivolity and everyone has an absolute right to mock and disparage other people’s frivolous interests, there’s something really off about pretending to disparage other people’s frivolous interests on the grounds that they’re frivolous. Everyone living even slightly above the subsistence level expends some time and resources on entertainment... and that’s an integral part of human existence. You don’t need to be a nihilist to want to watch a spectacle, you just need to be a human being.

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Thursday, April 28, 2011

You don’t need to be a nihilist to want to watch a spectacle...

Well done Bukowski... well done...

they live unfairly

saving the best part for paper. good human beings save the world

so that bastards like me can keep creating art,

become immortal.

if you read this after I am dead

it means I made it."

Tuesday, April 26, 2011

Boethius, Divine foreknowledge, and Free will

Without free will, neither condemnation or praise would be merited. Boethius is interested in this question because he wants to know if our prayers can affect God.1) If God has foreknowledge then God know beforehand with certainty everything I am going to do2) If God knows I am going to do something then necessarily I am going to do it.3) TF--> Everything I am going to do must necessarily take place4) If [3] then I am not free5) TF --> I am not free

Augustinian theodicy and the problem of Evil

The main traditional response to the problem of evil was formulated by Augustine. According to Augustine God is the highest good and is unchangeable. In contrast to God, everything created by God is necessarily good, although the amount of goodness can vary between created being. Created things are changeable in space and time, souls are changeable only in time.1) If God is omniscient (all-knowing) then God knows about evil2) If God is omnipotent (all-powerful) then God can destroy evil3) If God is omni-benevolent (all-loving) then God would want to end evil4) Evil exisits------------------------------TF: God either lacks one of the omni- characteristics, or,God does not exist.

Anselms Ontological Proof

1) We have an understanding of God who is "that than which nothing greater can be conceived" (TTWNGCBC)2) If God existed only in our understanding (A), and not outside our mind then God would not be the greatest possible being (B)3) It is greater to exist outside the mind than to exist only inside the mind4) God is "that than which nothing greater can be conceived"---------------------------------------------Therefore: God exists outside our minds and not just in our understanding

If A, then BNot B------------TF: Not A

Gaunilos critcisim: "The greatest possible island"

Sunday, April 24, 2011

individual mandate — the question is about market failure NOT Government vs. Personal Liberty

The current crop of GOP hopefuls, with the possible exception of Gary Johnson and perhaps a couple others, looks less than thrilling for libertarians (or really anyone). It is entirely possible that we will end up with a Huckabee, Romney, or other nominee that one could find impossible, or at least difficult, to support. Is anyone’s vote then going to Obama?

Libertarianism is often thought of as “right-wing” doctrine. This, however, is mistaken for at least two reasons. First, on social—rather than economic—issues, libertarianism tends to be “left-wing”. It opposes laws that restrict consensual and private sexual relationships between adults (e.g., gay sex, extra-marital sex, and deviant sex), laws that restrict drug use, laws that impose religious views or practices on individuals, and compulsory military service. Second, in addition to the better-known version of libertarianism—right-libertarianism—there is also a version known as “left-libertarianism”. Both endorse full self-ownership, but they differ with respect to the powers agents have to appropriate unowned natural resources (land, air, water, minerals, etc.). Right-libertarianism holds that typically such resources may be appropriated by the first person who discovers them, mixes her labor with them, or merely claims them—without the consent of others, and with little or no payment to them. Left-libertarianism, by contrast, holds that unappropriated natural resources belong to everyone in some egalitarian manner. It can, for example, require those who claim rights over natural resources to make a payment to others for the value of those rights. This can provide the basis for a kind of egalitarian redistribution.

Libertarians that put free-riding on taxpayer dollars as the greater evil than the imposition of a fee to help defray costs of health care market (which is a total market failure) will not necessarily have a problem with the individual mandate.

Here is a defense of the individual mandate over at Reason Magazine--which is a right-libertarian magazine-- which notes that, "the proposal for mandatory health insurance offers a way to maintain our private system, expand consumer choice, lower costs, and allow medical progress to continue."Morning reads...

Fresh clash at Thai-Cambodian border

Cambodian and Thai troops exchanged heavy weapons fire for the third straight day on Sunday, officials from both countries said, after clashes on their joint border left 10 dead.

A Cambodian field commander, Suos Sothea, said the fighting started at about 10:00 am local time (0300GMT) and both sides were firing mortars. "What we can confirm is it involves artillery shell fire," he said. A Thai official at the border also confirmed the resumption of hostilities and said "Cambodian opened fire first".

UN Secretary-General Ban Ki-moon has said the neighbors should "exercise maximum restraint" and urged the pair to launch "serious dialogue" in order to resolve the issue, according to a spokesman.

Six Cambodian troops and four Thai soldiers have been killed in the latest fighting.

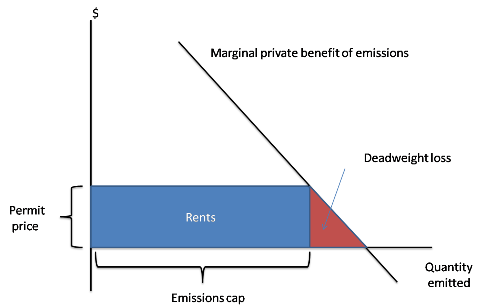

The textbook economics of cap-and-trade

Think of the benefits to the private sector from pollution. Yes, benefits — in the sense that it’s cheaper to pollute than not to, or that it’s easier to produce goods if you don’t worry about whatever emissions result as a byproduct. So we can think of drawing a curve representing the private marginal benefit of emissions, as in this figure:

In the absence of government action, the private sector will increase emissions up to the point where there is no further marginal benefit. That is, emissions will rise to whatever level is implied by profit-maximization, paying no attention to the effects on the environment.

A cap-and-trade system puts a limit on overall emissions, so that emitters have to pay a price for emitting. This price will, as shown in the figure above, equal the marginal benefit of the last unit of emissions allowed.

Now, the cost to the economy of this limit is the benefit the private sector would have gotten by emitting more than is allowed under the cap. It’s shown in the figure as the red triangle labeled “deadweight loss”. CBO puts these losses under Waxman-Markey at 0.2-0.7 percent of GDP in 2020, 1.1 to 3.4 percent in 2050. These costs have to be set against the environmental benefits.

In addition to this overall economic cost, there’s a distributional effect. The creation of cap and trade means that emission permits command a market price, and the value of these permits — the blue rectangle — goes to someone.

Saturday, April 23, 2011

Lucretius on Sisyphus and public office

Wednesday, April 20, 2011

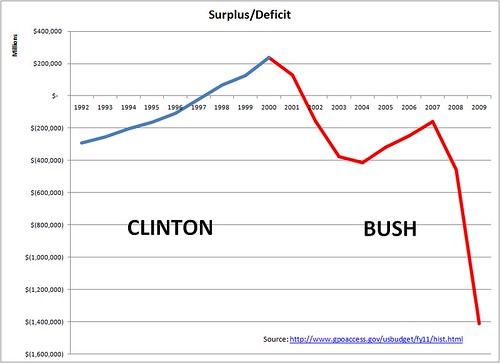

Addressing our medium-term fiscal problem

Addressing our medium-term fiscal problem will require spending restraint, a maxim to which all political factions pay lip service even while failing to offer credible, detailed plans for turning principle into practice. It will involve bending the health-care cost curve rather than imagining that public support for health care for the poor and elderly can be made magically to go away. And it will require revenue enhancement to pay for the infrastructure and education necessary for the U.S. to compete in the 21st century.

Tuesday, April 19, 2011

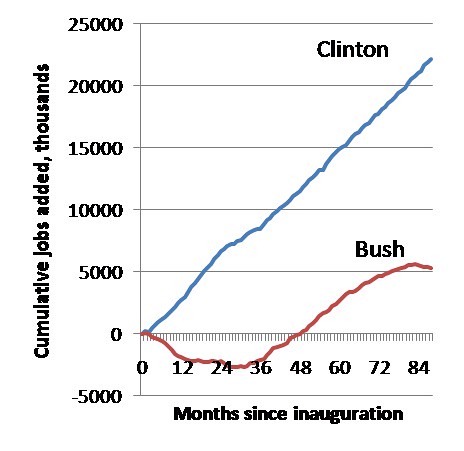

Higher taxes will destroy our economy

Many conservatives insist that at least some painful austerity is necessary for our economic survival. Otherwise, they warn, taxes will grow to unprecedented levels, slowing down the economy. Ross Douthat makes this point today in his New York Timescolumn. Philip Klein made a similar argument last week in the Washington Examiner.

I respect both writers and realize we have some fundamental, philosophical differences over the appropriate role for the state. But, as an empirical matter, I think the international evidence tell a very different story about taxes and the economy. As you can see from the above chart, which the Center on Budget and Policy Prioritiesconstructed using data from the Organization for Economic Co-operation and Development, the tax burden in the Nordic countries far surpasses ours. In fact, the tax burden in those countries exceeds 50 percent.

That money helps finance a welfare state far more comprehensive than ours, including not just universal health insurance but universal early childhood programs. But the Nordic countries are far from stagnant, innovation-starved backwaters. As economists like Columbia University's Jeff Sachs have pointed out repeatedly, these countries have thrived. In fact, the Nordic formula may actually bolster growth, because the income protection it provides makes the people of Scandinavia more willing to tolerate the dislocations that come with loose labor rules and free trade.

The Nordic countries are far more homogenous than the U.S. and it’s an open question whether a society as diverse and unequal as ours would support such a high tax burden. (This is one of the points Douthat makes in his column.) But even if we do absolutely nothing but let current law stand--in other words, if we let the Bush tax cuts expire, allow the alternative minimum tax to remain in place, allow scheduled reductions in physician fees to take effect, and limit the control of health care costs only to the official projections for the Affordable Care Act--it seems likely that our tax burden would still not exceed what the Nordic countries face today, at least not for another 50 years.*

I'm not saying that the "do nothing" approach, as Ezra Klein calls it, is ideal. Far from it. I’d prefer a more gradual and even-handed approach to reducing health care costs than imposing those physician cuts as scheduled. My ideal plan would look a bit more like the Bipartisan Policy Center’s plan, which certainly includes its share of cost-cutting, and the principles Nobel-winning economist Joseph Stiglitz has outlined. I also could live with a less progressive tax system if (and only if) it was for the sake of financing a more robust welfare state.

But my broader point is that a substantial rise in taxes is not the end of the world, particularly if it is gradual, finances smart investments, and includes reasonable but not draconian efforts to control health care costs.

You may not approve of a shift that moves America closer to the OECD norm, but that’s not the same thing as saying that it would be inconceivable or disastrous.

Now, higher taxes alone can’t resolve our long-run budget issues, because of rising health care costs, which will eventually swamp even a large tax hike if they continue. But cost-control for Medicare plus tax increases that put us closer to the middle of the pack — although still below average, and well below several successful European economies — is a perfectly feasible answer to our long-run deficit concerns.

Monday, April 18, 2011

About That Warning On U.S. Debt: Bond Investors Don't Care

If the U.S. doesn't figure out how to cut its long-term deficits, it could lose its top-notch credit rating, Standard & Poor's said today.This was big news, and lots of stories this afternoon suggested that the announcement caused stock prices to fall.

I don't have any idea why the stock market fell today. But if you want to see the effect of the S&P announcement, the bond market — not the stock market — seems like the first place to look. After all, the bond market is where the U.S. government goes to borrow money.

And bond investors didn't seem to care.If they were worried, you'd expect them to be selling Treasury bonds. That would drive up interest rates, making it more expensive for the government to borrow money.

But that didn't happen. The interest rate on 10-year and 30-year Treasury bonds actually fell a little bit today.

In other words, after S&P issued its warning about government debt, investors were more eager, not less, to lend the government money.

Ga. college tuition likely to rise, again

Tuition likely will rise for students attending Georgia’s public universities. The State Board of Regents is set to meet Tuesday to go over numbers and discuss an increase, reports Atlanta Business Chronicle broadcast partner WXIA-TV.

With an increase of more than 19,000 students this year alone, regent's executive John Millsaps said, "It's highly likely that it will have to increase to meet the needs of the students to me the student growth we have experienced.”

Over the years as enrollments swelled and faculty was added, tuition has taken the hit -- paying about 25 percent of what it costs to educate a student. The state picked up the rest, reports WXIA’s Bill Liss.

Now the pendulum has shifted even further, with tuition picking up a whopping 45 percent of the cost and the state only 55 percent, with the student footing the bill, according to WXIA.

In 1994, tuition jumped by $923 for a semester.

That number rose to more than $1,200 in 2001 and this year it's up as much as 16 percent -- which translates to a whopping $3,500, Liss reported.

MARTA starts $10.8 million solar project

MARTA will add solar panels to cover the 220 bus parking stalls at the transit agency’s bus maintenance facility in Decatur, Ga. Panels will be equipped with LED light fixtures that provide enough lighting for safety and maintenance activities at night, reports Fox 5-Atlanta.

The Metropolitan Atlanta Rapid Transit Authority announced the project Friday in advance of Earth Day on Friday.

The project is funded by a federal grant and is the second largest structure of its kind at a U.S. transit system.

Its health care spending...

America’s crazyquilt of public and private options left us spending more than $7,500 per person on health care — and that’s despite the fact that 50 million Americans are uninsured and tens of millions more are underinsured. That same year, Canada spent $4,079 per person. France spent $3,700. Britain spent $3,129. And no, we’re not living longer than they are, nor getting obviously better care. The irony is that if our health-care spending were more in-line with international norms, we’d have no deficit problem at all.

Op-Ed The Kia news keeps getting better for West Point, Georgia

The opening of the Kia plant in West Point, Ga., has changed the face of the small town and impacted the Interstate 85 corridor through West Georgia and East Alabama. And the good news keeps getting better as Kia continues to expand its operation at West Point.

Kia announced plans for the Georgia plant in March 2006. Vehicle production began on Nov. 16, 2009. Success of the Georgia Kia operation has been immense. A second production shift has been added, and this weekend, giant equipment from Korea to build a new stamping press is being trucked from the Port of Savannah along interstate highways to the West Point plant in order to allow another expansion.

This additional expansion is necessary to meet the demand for Kia Georgia vehicles.

Due to our success we will hire as many as 1,000 additional team members throughout 2011 to produce top quality vehicles adding strength to the U.S. economy,” said Randy Jackson, Kia’s director of human resources in Georgia.

When the West Point plant gets to full capacity it will have the capability of building 300,000 vehicles annually. Jackson said, “We expect the number of jobs created by KMMG and suppliers will amount to more than 10,000.

That’s an amazing success story for Kia, for Georgia and especially for the small town of West Point. Before Kia arrived, West Point had fallen on hard economic times because of the massive shutdown of textile plants in the area.

Op-Ed The Kia news keeps getting better for West Point, Georgia

The opening of the Kia plant in West Point, Ga., has changed the face of the small town and impacted the Interstate 85 corridor through West Georgia and East Alabama. And the good news keeps getting better as Kia continues to expand its operation at West Point.

Kia announced plans for the Georgia plant in March 2006. Vehicle production began on Nov. 16, 2009. Success of the Georgia Kia operation has been immense. A second production shift has been added, and this weekend, giant equipment from Korea to build a new stamping press is being trucked from the Port of Savannah along interstate highways to the West Point plant in order to allow another expansion.

This additional expansion is necessary to meet the demand for Kia Georgia vehicles.

Due to our success we will hire as many as 1,000 additional team members throughout 2011 to produce top quality vehicles adding strength to the U.S. economy,” said Randy Jackson, Kia’s director of human resources in Georgia.

When the West Point plant gets to full capacity it will have the capability of building 300,000 vehicles annually. Jackson said, “We expect the number of jobs created by KMMG and suppliers will amount to more than 10,000.

That’s an amazing success story for Kia, for Georgia and especially for the small town of West Point. Before Kia arrived, West Point had fallen on hard economic times because of the massive shutdown of textile plants in the area.

Thursday, April 14, 2011

Ryan’s Budget Gives Obama What He Wants

Republicans have succumbed to a strange mood of simultaneous euphoria and paranoia. Republicans have convinced themselves both that: (1) American freedom stands in imminent danger of disappearing into totalitarian night; and (2) that the vast majority of the great and good American people are yearning for a mighty rollback of big government, even at considerable personal sacrifice.

And so Republicans have united around Rep. Paul Ryan’s (R-Wis.) proposal that for the first time in modern conservative history explicitly joins a big tax cut for the rich to big cuts in health care spending for virtually everybody else. If this were a tennis game, the Republicans would be placing the ball in exactly the spot on the court where it must never, ever go.

Is corruption the flip side of rapid economic growth?

Is corruption the flip side of rapid economic growth? History appears to answer this provocative question with a heretical yes.

The exemplary instance is the Gilded Age in the United States, the era of the robber barons. It was a period of rapid growth, rampant corruption, rising wealth and income inequality.

Recently, Ashutosh Varshney, a political science professor at Brown University, has drawn the striking comparison between that age and contemporary India, which too features dizzyingly rapid growth, a new class of superrich entrepreneurs, a clutch of crooked politicians and a seemingly unceasing carousel of corruption scandals.

Historical analogy is tricky, but it is certainly true that India today broadly resembles the earlier American experience, both in the rapidity of economic growth and the structural transformation from an agrarian to a modern economy, and the accumulation of staggering fortunes, often through illicit means, with the attendant widening gaps between rich and poor.

One could equally point to other large emerging economies, such as Brazil, Russia or China (with India, the BRICs), which all have experienced this combination of rapid growth, rising inequality and corruption.

What is the explanation? In all of these cases, the causal mechanism is the same: Unregulated capitalism generates both rapid growth and burgeoning inequality.

In the absence of legal channels for influencing policy, such as the lobbying and campaign contributions in the United States, such attempts manifest themselves as corruption. That was true of the American Gilded Age, and it is true of the BRICs now.

Is it fair to say, then, that corruption and inequality are natural byproducts of the early stages of market-based capitalism? A superficial survey of history, from Bismarck’s Germany to Japan after World War II to East Asia in the 1970s and 1980s, seems to bear this out. Indeed, this might come to be accepted as a social-science theory, like the Kuznets curve, which shows that inequality first rises and then falls with the level of development. It could, in fact, be part of the explanation for this phenomenon.

The American experience also suggests a corollary proposition. Excessive corruption and inequality, by corroding the political process, threaten to delegitimize capitalism and the market system and so create pressures for reform and the redistribution of wealth that then temper the incentive-driven impetus to capitalist growth, which caused the inequality in the first place.

The necessity for redistribution and social policy thus becomes a mechanism for the system to correct itself. In the United States, it took the better part of the half-century preceding World War II for this to occur. The worst excesses of capitalism were reined in only when a middle class backlash led to legislative change, regulatory reform and anti-corruption rules.

In China, such a process has yet to begin, and is not likely to unless the regime perceives an existential threat. In India and in other poor democracies, by contrast, the pressures for redistributive and social policies are irresistible.

Everyone Has An Ideology

Various reports suggest that in today’s speech Obama will try to position himself as a pragmatist, as opposed to the ideologues of right and (probably) left. We’ll see how that works; as I recall, the last president we had who viewed himself primarily as a manager was … Jimmy Carter.

But I’d also like to register a philosophical protest. There’s an old joke to the effect that you’re an ideologue; I’m just being sensible. The point is that everyone has an ideology — which is another way of saying that everyone has (a) values and (b) some view about how the world works. And there’s nothing wrong with that.

Let me illustrate the point: suppose I were to propose reducing the national debt by offering private businesses the right to buy contracts on the couple of million prisoners in our jails, who would then become indentured workers — in many cases for life. Oh, and let’s add indentured servitude as a replacement for personal bankruptcy. What’s that? You say that reintroducing what amounts to slavery is unacceptable? Well, that’s just your ideology — and a significant number of Americans probably don’t share that ideology.

So yes, I’m an ideologue. I believe in a more or less Rawlsian vision of society — treat others as if you could have been them — which implies a strong social safety net. I also believe that a mostly market economy, with public ownership and provision of services only in some limited areas, works best. Others will disagree with my values, my sense of how the world works, or both. Let’s not pretend that we share more than we do.

A Universal Library by Peter Singer

Tuesday, April 12, 2011

This might explain part of our problem...

Food Bank/Free Clinic/Health Care Center Sales Tax Exemption

Food Bank/Free Clinic/Health Care Center Sales Tax Exemption

Important sales tax exemptions for food banks, free clinics and federally qualified health centers have expired. What this means is that these specific agencies will now have to pay sales taxes on all the food and supplies that they buy to serve the most vulnerable Georgians. Since they have expired, we need to get them reinstated and the only way to do this is to add some language to a bill that has the promise to pass on the floor. Please call the following and show them you support reinstatement of these important expemtions.

Sen. Bill Heath 404-656-3943

Sen. Lindsay Tippins 404-657-0406

Sen. Ronnie Chance 404-651-7738

Sen. Hardie Davis 404-656-0340

Sen. Tim Golden 404-656-7850

Sen. Jack Hill 404-656-5038

Sen. Chip Rogers 404-463-1378

Sen. Mitch Seabaugh 404-656-6446

Sen. David Shafer 404-656-0048

Sen. Cecil Staton 404-656-5039

Sen. Steve Thompson 404-656-0083

Rep. Larry O'Neal 404-656-5052 (House Majority Leader) Chris Riley in Governor Deal's office 404-656-1776

Irene Munn in Lt. Gov. Casey Cagle's office 404-656-5030

"If all we had known when this crisis struck was 1950-vintage macroeconomics..."

Monday, April 11, 2011

Ryan Proposal Will Lead to Large Rise in Health Care Costs for Seniors

Representative Paul Ryan’s 2012 budget plan has been lauded as a serious approach to the budget that will lead our nation on a “path to prosperity”. A new issue brief from the Center for Economic and Policy Research (CEPR) demonstrates that the Medicare portion of the Ryan plan shifts rising costs to beneficiaries.“Ballooning health care costs continue to be the main source of the rise in future deficits,” said Dean Baker, an author of the brief. “The Ryan plan does nothing to address the projected explosion in health care costs. Instead it just shifts the burden of these costs more squarely on the shoulders of seniors.”

Using data from the CBO analysis of the Ryan plan, the brief specifically shows:

- A comparison of costs under the Ryan plan and the current system in 2022, 2030, and 2050

- The costs as a share of income to a 65-year-old Medicare beneficiary in 2022, 2030, and 2050 at the 40th, 50th, and 70th income quintiles

- The implied dollar value of premium support, beneficiary payment and additional payments to providers under Ryan plan and the current plan in 2050

- The cumulative additional payments to providers over the 75-year Medicare projection period resulting from implementation of the plan

While many claim that Rep. Ryan’s plan would put the nation on the road to greater fiscal responsibility, the savings on Medicare come at the expense of ensuring quality care for retired workers while providing a windfall for insurers and providers.

The trucks won't load themselves... 4.11.2011

It's not that I'm so smart, it's just that I stay with problems longer. --Albert EinsteinA life spent making mistakes is not only more honorable, but more useful than a life spent doing nothing. --George Bernard Shaw

Taxes and Spending for Beginners

Over the long term, we are projected to have large and growing federal budget deficits. Assuming that is a problem, which most people do, there seem to be two ways to solve this problem: raising taxes and cutting spending. Today, the political class seems united around the idea that spending cuts are the solution, not tax increases. That’s a given for Republicans; Paul Ryan even proposes to reduce the deficit by cutting taxes. But as Ezra Klein points out, President Obama and Harry Reid are falling over themselves praising (and even seeming to claim credit for) the spending cuts in Thursday night’s deal. And let’s not forget the bipartisan, $900 billion tax cut passed and signed in December.

The problem here isn’t simply the assumption that we can’t raise taxes. The underlying problem is the belief that “tax increases” and “spending cuts” are two distinct categories to begin with. In many cases, tax increases and spending cuts are equivalent — except for the crucial issue of who gets hurt by them.*

Social Security is probably the simplest example of this equivalence. The Social Security Trust Fund is scheduled to be exhausted around the late 2030s, but from that point the program’s revenues (from the payroll tax) will be sufficient to pay something like 75 percent of currently scheduled benefits for several decades.So, you might say, we have two ways to fix this: tax increases (either increase dedicated taxes or take money from general revenues, which will require raising some other tax) or benefit reductions. Needless to say, most Social Security proposals, such as that put forward by the recent deficit commission, largely involve benefit reductions, although they also include modest increases in the payroll tax.

Plan A would simply be to cut benefits across the board by 25 percent starting in the late 2030s, so the amount being paid out equals the amount coming in from payroll taxes. This looks like a spending cut — we’re closing the fiscal gap by reducing spending — so Republicans and moderate Democrats should like it.

What if, instead, we leave benefits exactly where they are and impose a 25 percent tax on Social Security benefits? This looks like a tax increase, where we’re closing the fiscal gap by increasing taxes, meaning “bigger government” (cue the charges of “socialism”). But this tax increase is equivalent in every way to the spending cut above; it’s just another way of framing Plan A.

If a 25 percent across-the-board benefit cut is the “conservative” solution, then the “liberal” solution, Plan B, is to increase the payroll tax by 33 percent, from 12.4 percent to about 16.5 percent.** This is harder to see as a spending cut, but for most people it is equivalent to a spending cut. We pay more during our working years and get back the same amount when we retire; since cash is cash, this is equivalent to paying the same amount while working and getting back less in retirement.

In short, both Plan A and Plan B can be broken down into two components: (1) keeping currently scheduled benefits intact and (2) increasing taxes on someone to pay for it. The difference between them has nothing to do with cutting spending or raising taxes — it has to do with whose taxes get increased.

Under Plan A, we are imposing a tax on seniors equivalent to 25 percent of their Social Security benefits. This is a regressive tax because the richer you are, the smaller Social Security is as a component of your income. We are also raising all of the revenue from seniors, so it’s a large tax increase on a small base.

Under Plan B, by contrast, we are imposing an incremental tax on all wage earners equivalent to 4.1 percent of their wages. This is still slightly regressive because of the cap on earnings subject to the payroll tax, but it’s a lot less regressive than the tax in Plan A. It’s also a small tax levied on a broad base, so it is less of a shock to individual households.***

Now, there are still valid arguments to be made in favor of Plan A. You could argue that increasing the payroll tax rate will hurt the economy because businesses won’t hire as many workers. This is true, but it’s also true that increasing taxes on seniors will hurt the economy because they will buy less. You could also argue that progressive taxes are bad and taxes should be as regressive as possible, and hence Plan A is better than Plan B. I wouldn’t agree with you, but you could argue that.

But you can’t argue that Plan A is better than Plan B because Plan A cuts spending and Plan B raises taxes. When you’re dealing strictly with cash going back and forth between households and the government, that distinction is nonsense.

Most Social Security proposals are more complicated to think about than Plan A and Plan B because they involve changes in the full benefit age, the benefit calculation formula, the index used for cost of living adjustments, and so on. But they all can be boiled down to the following: relative to current taxes and currently scheduled benefits, who gets more cash and who gets less cash? That’s all that matters — not whether they increase taxes or cut spending.

America's deficit: A brief word about the budget deal | The Economist

I think it's worth remembering a few important things. First, the federal government did not need to cut spending in this fiscal year. There is no immediate fiscal crisis; on the contrary, yields on American government debt remain extraordinarily low. Second, macroeconomically speaking, now is a bad time to be cutting spending. The economy remains very weak, state and local governments are already trimming back public spending and placing a big drag on economic activity, and there's plenty of contractionary developments in the pipeline already, from the impending end of QE2 to the impact of rising oil prices. Since the government didn't need to cut and shouldn't, from a macroeconomic perspective, have been cutting in the first place, it's hard to understand why anyone thought it was a good idea to threaten a damaging government shutdown in order to cut.

Third, had America actually been facing a crisis or had it simply been an opportune moment to trim back state spending, this was just about the worst way to go about cutting. The cuts don't touch on the real sources of the long-term budget problem. They impact important programmes and are therefore of questionable sustainability. Little to no effort was made to identify cuts with the best economic return. And the Republicans made a joke of the whole process by larding their demands with fiscally irrelevant riders, most of which seem tailored to enrage Democrats.

Everyone involved should be embarrassed. But few journalists seem to think that this absurd sequence of events will in anyway reduce the likelihood of an even greater mess down the road when it comes time to raise the federal debt ceiling. The case for raising the debt ceiling is incredibly strong. For one thing, not raising the debt ceiling could be end up being really bad; the government would have to engage in major gymnastics to avoid a default. For another, not raising the debt ceiling would not address the government's deficits; deficits and debts are residuals. If you want to actually limit them you have to identify spending that should be cut and taxes that should be raised. What's more, the leaders of both parties say that the debt ceiling should be raised. Most everyone wants to do something which most everyone agrees should be done.

And yet, the government will likely be pushed to the edge of crisis. These fights are risky and counterproductive. Sadly, I suspect that the reaction of most of the Washington press corps will be to—once again—get so caught up in the tick-tock of the dramatic showdown that they'll neglect to point out just how magnificently the elected leadership in Washington is failing its citizenry.

Sunday, April 10, 2011

Umm... what happened to leaving it up to the market?

A small but influential group of economists and educators is pushing another pathway: for some students, no college at all. It’s time, they say, to develop credible alternatives for students unlikely to be successful pursuing a higher degree, or who may not be ready to do so.

Whether everyone in college needs to be there is not a new question; the subject has been hashed out in books and dissertations for years. But the economic crisis has sharpened that focus, as financially struggling states cut aid to higher education.

Among those calling for such alternatives are the economists Richard K. Vedder of Ohio University and Robert I. Lerman of American University, the political scientist Charles Murray, and James E. Rosenbaum, an education professor at Northwestern. They would steer some students toward intensive, short-term vocational and career training, through expanded high school programs and corporate apprenticeships.

“It is true that we need more nanosurgeons than we did 10 to 15 years ago,” said Professor Vedder, founder of the Center for College Affordability and Productivity, a research nonprofit in Washington. “But the numbers are still relatively small compared to the numbers of nurses’ aides we’re going to need. We will need hundreds of thousands of them over the next decade.”

Thursday, April 7, 2011

ECB hikes interest rates in exit from crisis policy

The European Central Bank raised interest rates by 25 basis points to 1.25 percent on Thursday, announcing its first hike since July 2008 to counter firming inflation pressures in the 17-countryeuro zone.

The increase in the ECB's benchmark refinancing rate marks a gentle exit from the central bank's policy response to the global financial crisis. It had held the refi rate at a record low 1.0 percent since May 2009. "This makes the ECB the first major developed economy central bank to hike rates and the decision will cement its reputation as a single-minded inflation fighter," said ABN Amro economist Nick Kounis. "The hike is unwelcome for peripheral countries, but arguably the core member states were in need of this move already some time ago. In that sense, the timing of the increase is a balancing act, which is part and parcel of the one-size-fits-all monetary policy," he added.The euro and German bund futures were steady after the decision, which ECB policymakers had flagged heavily in advance. All but four of 80 economists polled by Reuters last week expected a 25 basis point rise.