I suspect that this article by Heleen Mees will get a lot of attention from the inflationistas, who will see in it another reason to worry. So I guess I’d better weigh in to say that the, um, core argument doesn’t seem to make any sense.

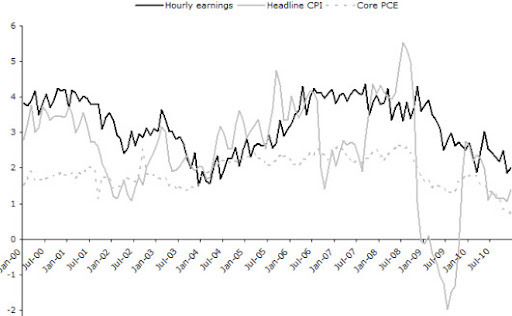

Mees looks at this picture:

and tells us that it shows that “Hourly wages in the US track headline inflation much more closely than core inflation.” Huh?

What I see is two sluggish series, core inflation and wages, and one very volatile series, headline inflation. Neither the 2008 surge in headline inflation nor the deflation of 2009 were reflected at all in wages. How is this “tracking”?

What Mees seems to mean is that over the whole period wages grew more than core prices. But that’s supposed to happen! We expect real wages to rise over time, as productivity gains are passed on to workers. (There’s been a lot of slippage in the passthrough lately, but that’s another issue.) And when Mees says,

That hourly wages increase on average more than headline inflation is mainly due to downward wage rigidity.

you really have to wonder: does she mean that any real wage increase, any time, must be due to wage rigidity?

I’m also baffled by the claim that Bernanke was wrong to view the 2007-2008 bulge in inflation as temporary, because commodity prices are high again. That seems to involve a confusion between level and rate of change: Bernanke wasn’t saying that he knew oil prices would go down, he was saying that he didn’t expect them to keep rising at the same rate.

The second figure does show something interesting, namely, a correlation between unit labor costs and headline inflation — although that correlation mainly reflects the fact that both headline prices and unit labor costs plunged in the 2008-2009 crisis.

But unit labor costs are not a price; they’re a price (wages) divided by productivity. What we’re seeing here is something we already knew, that productivity surged in the face of the crisis, presumably as employers found themselves able to demand more for less. Thatt’s interesting and important, but it’s hard to see what it has to do with headline inflation.

The bottom line is that the evidence presented here does not at all justify the claim that headline inflation is the place to look. In fact, it’s possible (and I have) to point to the very same evidence as a reason why monetary policy should focus on slow-moving measures like wages and core prices, not on volatile headline inflation.

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Wednesday, May 4, 2011

Headline Inflation and Wages

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment