A Republican state lawmaker is pushing legislation that would restrict abortions in Georgia based on the argument that fetuses can feel pain after 20 weeks.Nebraska's law outlaws abortion after 20 weeks of pregnancy based on the disputed claim that fetuses can feel pain after that point. It's a departure from the standard of viability, established by the 1973 landmark U.S. Supreme Court ruling in Roe v. Wade. That ruling allows states to limit abortions in cases where there's a viable chance the fetus could survive outside of the womb, generally considered to be between 22 and 24 weeks.State Rep. Allen Peake of Macon said Monday that his bill — co-signed by some members of House leadership — was modeled on a new law in Nebraska.

————

House Bill 89: www.legis.ga.gov

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Monday, January 31, 2011

Ga. lawmaker pushes fetal pain abortion bill

zerobased budgeting

So far I still have yet to hear from anyone on if there has been any effort to look in to the increased workload/manpower question involved with zerobased budgeting. Is it just me or is this a great example of a sounds good/feels good policy where we aren't giving the tools/revenue needed to do the job.... and making government less effective...

Libertarian Party of Georgia Legislative Update

2011 Libertarian Party of Georgia Legislative Update #4

Last week, the General Assembly was largely dominated with Committees getting underway and more bills being introduced. Because few working Committee meetings have been held so far, few bills have made it out of Committee, meaning Floor sessions were largely dominated by Morning Orders and Points of Personal Privilege, where Representatives and Senators speak on any issue they so desire.

Sunday, January 30, 2011

Legislative Update from Rep. Brett Harrell

as the State Director of Planning. I was also assigned to the Ports and Local Government Sub Committee.Monday, January 24 began our third week of the 2011 Session and committees began meeting to organize and start reviewing potential legislation. My first committee meeting was Thursday and it was a joint Senate / House Transportation Committeemeeting where I had the honor of voting to confirm an outstanding Georgia Department of Transportation employee, Georgia Tech grad, Gwinnett resident, and friend Todd Long

While passing a balanced state budget remains our primary duty, other vital issues will impact this year's legislative session. Everyday new legislation addressing those issues is drafted, introduced, and assigned to the various committees in the House for review. Among these are legislation addressing issues like illegal immigration, tax reform, and health insurance. With that in mind, I would like to make you aware of some important matters that will arise in the next few weeks of session.

Co-Chaired by Representative Matt Ramsey (R-Peachtree City), the Special Committee on Immigration Reform worked throughout the summer and fall to study the economic impact of illegal immigration in Georgia. Currently, there are an estimated 400,000 plus illegal immigrants in our state. Though illegal immigrants do not pay state income taxes, they do utilize state resources that are funded by taxpayer dollars. As a result, classrooms are more crowded, our healthcare system is at its limits, transportation infrastructure is overburdened and our law enforcement community is working feverishly to do more with fewer resources. With this in mind, Rep. Ramsey took the findings from the immigration reform committee and sponsored House Bill 87, the Illegal Immigration Reform and Enforcement Act of 2011.

HB 87 strives to protect taxpayers from the unlawful burden of funding services for illegal immigrants. It includes measures to expand the use of the E-Verify system to private employers, requires secure and verifiable identification for official purposes, and helps local law enforcement agencies handle the various issues associated with illegal immigration. It is important to note that this legislation will not affect the legal migrant workers who come to Georgia through federal work programs.

HB 59 that I co-sponsored also addresses illegal immigration by requiring students attending publically funded colleges and universities are lawfully present to do so.

Healthcare will also receive a great deal of attention throughout this year's legislative session. House Bill 47 that I joined as a co-signer would allow insurance companies licensed in Georgia to sell health insurance products that are approved for sale in other states. By doing this, Georgia would create a more open insurance market with greater competition, which would ultimately result in less expensive health insurance for Georgians.

As these and other pieces of legislation begin to make their way through the legislative process, I will continue to send these updates to keep you apprised of the major legislation being considered at the state capitol. In return, I hope that you will alert me to any questions or concerns you may have about any issue that affects your family or community. You can reach me at my Capitol office at 404-656-7859 or email me at brett.harrell@house.ga.gov.

Thank you for allowing me to serve as your representative,

Brett Harrell

Egypt’s Class Conflict

The military regime in Egypt initially gained popular legitimacy in part by its pluck in facing down France, Britain and Israel in 1956-57 (with Ike Eisenhower’s help). After the Camp David accords, in contrast, Egypt largely sat out the big struggles in the Mideast, and made what has widely been called a separate peace. Egypt’s cooperation in the Israeli blockade of Gaza and its general quiet alliance with the US and Israel angered most young people politically, even as they racked up economic frustrations. Cairo’s behind the scenes help to the US, with Iraq and with torturing suspected al-Qaeda operatives, were well known. Very little is more distasteful to Egyptians than the Iraq War and torture. The Egyptian state went from being broadly based in the 1950s and 1960s to having been captured by a small elite. It went from being a symbol of the striving for dignity and independence after decades of British dominance to being seen as a lap dog of the West.

The failure of the regime to connect with the rapidly growing new urban working and middle classes, and its inability to provide jobs to the masses of college graduates it was creating, set the stage for last week’s events. Educated, white collar people need a rule of law as the framework for their economic activities, and Mubarak’s arbitrary rule is seen as a drag here. While the economy has been growing 5 and 6 percent in the past decade, what government impetus there was to this development remained relatively hidden– unlike its role in the land reform of the 1950s and 1960s. Moreover,the income gained from increased trade largely went to a small class of investors. For instance, from 1991 the government sold 150 of 314 state factories it put on the block, but the benefit of the sales went to a narrow sliver of people.

Voices for Georgia's Children blog posts...

This week's posts include:

1/29: Childhood memory: Picking parsley with grandpa. Why we need to teach our children positive food habits. Whenever I eat fresh parsley I’m immediately transported back in time to my nanny and grandpa’s mint green kitchen...

1/28: Right Now: 57% of Georgia’s kids are eligible for free and reduced lunches. Today I heard that more than 57% of Georgia’s kids are eligible for free and reduced lunches in public schools. According to statistics on the StateMaster website, Georgia places fifth in the nation in number of eligible kids...

1/28: Losing $2.9 Million from Children 1st is a Bad Idea. The Department of Community Health’s program, Children 1st, screens all newborns and children up to age 5 to identify those who are at risk for poor health and developmental outcomes...

1/28: Cutting Medicaid Hurts Kids – Especially Now! As advocates for children and families in Georgia, we are concerned about recent attempts within states to scale back vital health care programs for our most vulnerable citizens...

1/27: Business Lesson for State Government: Child Care. Why did three Georgia companies merit placement on Fortune magazine’s list of 100 Best Companies to Work For? Because they support child care for their employees, including summer camps in some cases...

1/27: Where do you start to explain the dilemma our kids face? Looking at the fact that about one child out of five in Georgia lives at or below the poverty level, and that more than a third of Georgia’s kids live in a family where no parent has full-time, year-round employment, where do you start to explain the dilemma our kids face?

1/24: Federal Budget Proposals and Georgia’s Kids. Overall, Georgia House and Senate committees are just getting warmed up, having organizational meetings and starting to examine agency budgets in a little more detail than perhaps they did last week during the FY11/FY12 budget hearings...

State Rep. Steve Davis' Capitol Update

The House and Senate have concluded their Joint Budget hearings for Fiscal Year 2011. My priorities for the session are maintaining the funding for I-75 expansion throughout Henry County, maintaining the funding for the new technical school in McDonough, and getting Georgian’s back to work.

The FYA 2011 Budget maintains the funding for Henry County to add two lanes (one Northbound, one Southbound) to I-75 from Eagles Landing Pkwy to Hwy 155 in south McDonough. Also funding for the construction of the Southern Crescent Technical College in McDonough is in the FY 2012 budget and will most likely be the only new technical college construction this year. The new technical school in Henry County is something that I have been fighting for since I was first elected in 2004. Moreover, GRTA Xpress bus service is receiving $5.4 million dollars to maintain operations for an additional year. This service has been very popular in Henry County for congestion relief and I will continue to support the funding.

Republican Leadership

During the budget hearings I met with Governor Deal to express the important needs of Henry County and why Henry needs to be a top priority. I expressed the concerns of the constituents of the 109th to Governor Deal on the issue of education. We also discussed the work of the Education Study Committee on Diploma Options that was brought about by my education reform bill, Graduating Everyone Matters (GEM), which I will reintroduce this year.

I am also working very closely with our new State School Superintendent John Barge on a bill that will reestablish the superintendent’s powers to hire a team that is best suited to work towards the goals he is establishing within the GDOE.

As the new Chairman of Information and Audits, I will oversee the House Journals, House Fiscal Office, and administratively oversee the Georgia Department of Audits and Accounts (GDAA).

I was already familiar with everyone in the House Fiscal Office and the Clerk’s Office who manage the Journals, so it was a very smooth transition from the previous chairman.I also met with the Director of the Georgia Department of Audits and Accounts, Mr. Russell Hinton. We discussed the role and purpose of the GDAA and how he thinks it could be improved. I believe the GDAA can play a unique role in Georgia’s budget process, because now, more than ever, we must ensure that there is no waste in Georgia’s Government.

Moving Forward

I am working very hard to make sure that Henry County receives the return of needed funding for our priorities from the state budget. Representative Welch and I have been coordinating the passage of resolutions by the county, school board, and all the cities in support of the new technical school in McDonough. Additionally we are obtaining support letters from industry leaders throughout our community.

Health Care and the low quality of policy debate in state politics...

Friday, January 28, 2011

Two upcoming town halls in metro ATL

will focus on the 2011 state budget. Facing a $1.5 billion budget gap, Republican lawmakers have proposed cuts to education, healthcare and public safety. A proposal by the Special Council on Tax Reform and Fairness for Georgians would add a tax on groceries, cigarettes, and prescription medicines.

Join me for two Town Halls!

Sunday, Jan. 30 from 3 to 5 p.m.

Clarkston Campus, Georgia Perimeter College

555 N. Indian Creek Drive

Clarkston 30021

Student Center-Building CN- Room 2240

Representatives Karla Drenner, Michelle Henson and I will co-host the event, whichwill focus on the 2011 state budget and will feature Allan Essig, executive director of the Georgia Budget and Policy Institute, as the guest speaker.

Tuesday, Feb. 1 from 6 to 7 p.m.

Decatur City Hall

509 N. McDonough St.

Decatur 30030

Senator Jason Carter, Minority Leader Stacey Abrams Representative Mary Margaret Oliver, Mayor Bill Floyd and I will co-host the event, which

Georgia Budget and Policy Institute Weekly Legislative Update

State Revenues

State revenues for the first six months of this fiscal year are running 8.1 percent ($588 million) ahead of the FY 2010 revenue collections. More than $127 million of the growth is accounted for by a decrease in the number of refunds distributed. Discounting fewer refunds distributed, actual revenue growth is 4.5 percent.

The governor's FY 2011 revenue estimate projects an increase in revenues of 4 percent ($610 million). It seems highly likely that the fiscal year will end in a surplus of several hundred million dollars, which the governor has stated will be used to begin rebuilding the Revenue Shortfall Reserve.

According to the governor, his FY 2012 revenue estimate is a modest 3.75 percent. The governor included in his FY 2011 base $288 million in one time revenues from the GEFA monetization. Not taking into account the one time revenues from the GEFA monetization and comparing growth in taxes and fees, the revenue estimate actually projects a more substantial increase of 5.8 percent compared to FY 2011 projected collections. However, to drive a surplus of $300 to $400 million in FY 2012 to continue rebuilding the Revenue Shortfall Reserve, revenues would need to grow between 7 and 8 percentHouse and Senate CalendarThe House and Senate are scheduled to go into session for the seventh legislative day on Monday, January 31.State Budget: FY 2011 Amended and FY 2012

ProcessGovernor Deal released his proposed budgets on January 12, 2011. The House and Senate appropriations subcommittees will meet throughout the week on the Amended FY 2011 Budget. (Download the proposed budgets.)GBPI Analysis The governor's FY 2012 budget proposal is disappointing in that it does not take a balanced approach to solving the state deficit. The budget contains additional cuts to education, with significant cuts to higher education, as well as cuts in services to our most vulnerable populations. A balanced approach to the fiscal crisis that includes additional revenues would assure that the factors most important to economic growth in the state, such as higher education, receive the necessary resources for Georgia toprosper.The following are GBPI analysis:

Governor's Proposed Health Budgets Governor's FY 2012 Education Budget Proposals: The Cuts Continue Human Services is "Down to the Bone": Highlights of the Governor's FY 2012 DHS Budget SB 1 - Zero Based BudgetingDuring the 2010 session of the General Assembly, SB 1 passed the General Assembly but was vetoed by Governor Perdue. On January 27, the State Senate voted to override the veto by a vote of 52-0. SB 1 requires that in any given year the governor's budget report includes zero-based budgeting for no more than one-third and no less than one-quarter of all programs. Each budget unit will be required to include in its budget estimate an analysis summarizing past and proposed spending plans organized by program and revenue source. The House is not expected to take up the override, but instead is expected to move forward this session on another Zero-Based Budgeting bill (HB 33).Fiscal and Tax PolicySeveral Options Would Lessen the Tax Shift Proposed in the Tax Council's Recommendations

The Special Council on Tax Reform and Fairness for Georgians released their recommendations on January 7. The recommendations include some much needed changes that will help our tax system better reflect today's economy, such as the move to expand the sales tax to services. Although many of the recommendations mirror GBPI's own recommendations for tax reform, there are also some concerning elements, such as the imposition of state sales tax on groceries and the resulting shift of taxes onto those least able to afford it.

GBPI offers adjustments that would lessen that tax shift:

- Maintain the grocery exemption and lower the income tax rate to 4.5 percent rather than the 4 percent recommended by the Council;

- Lower the state sales tax rate to 3.5 percent and lower the income tax rate to 4.5 percent rather than 4 percent;

- Re-craft the proposed personal income tax credit into a robust, refundable low income tax credit and targeted standard deduction.

Download GBPI's analysis here, and look for GBPI's editorial in Sunday's Atlanta Journal-Constitution.

TABOR Bill Passes Senate Finance Committee

The Senate Finance passed Senate Resolution 20 on Wednesday. The constitutional amendment would restrict state spending to a formula of population plus government inflation, similar to Colorado's TABOR.

In 2005, Colorado voters suspended the TABOR formula for five years to stop the many harmful budget cuts that had occurred under TABOR. Since Colorado adopted TABOR in 1992, more than 20 state legislatures have rejected TABOR, and it has been voted down in every state in which it reached the ballot, according to the Center on Budget and Policy Priorities. Business leaders, elected officials from both parties, and higher education officials, among others recognize that TABOR has limited Colorado's ability to fund critical services. Click here to watch a video on this issue. Senate Resolution 20 moves to the Senate Rules Committee.

First Tax Expenditure Report ReleasedThe budget included a new feature this year that brings more transparency to spending made through the tax code. Georgia has more than 100 tax exemptions and credits; however, prior to this budget, the state did not have an annual accounting of the cost of these programs. Senate Bill 206 passed last year and requires that the governor's budget sheds light on tax code spending through an annual tax expenditure report. Legislators will have an opportunity to see where the tax code spending happens and debate whether those dollars would be better spent in direct spending on services or in lower tax rates for the rest of taxpayers. State leaders will nowneed to explore what additional reporting and evaluation should occur so that tax breaks aren't just transparent but also accountable to Georgians.

Zero based budgeting -- Ga. Senate overrides Perdue budgeting veto

Wednesday, January 26, 2011

There Are Still No Fiscal Conservatives In The United States

Unfortunately, most of our political elite – both left and right – is still living in a land of illusions. They cannot even seriously discuss what would be required to bring our true fiscal position under control – remember that most of the recent damage to our collective balance sheet was done by big banks blowing themselves up. No one who refuses to confront the power of those banks can be taken seriously as a fiscal conservative.

More post-SOTU Liberal Media Bias...

It's normal for the opposition party to deliver a rebuttal address to the State of the Union. Last night Rep. Paul Ryan of Wisconsin was given that responsibility. But further-to-the-right Rep. Michelle Bachmann of Minnesota delivered the "Tea Party" response to the State of the Union, which was initially scheduled to air on the Tea Party Express website.

That is, until CNN decided it would air it on television. Which meant, as Washington Monthly's Steve Benen put it, CNN broadcast "the president's address, followed by a speech by a far-right Republican, and then followed by another speech by a different far-right Republican."

In response to CNN's justification--that the Tea Party is a "major political force"--he wonders:

Would CNN be inclined to air a SOTU response from the AFL-CIO? Labor unions are a major political force.

I think we know the answer to that one.

The Washington Post, meanwhile, voiced an odd concern about all this in a news article today, wondering whether the GOP message would get lost in the shuffle:

This year, the dueling responses probably made it even harder for either Republican to be heard.

Would viewers remember Ryan, using only his expressive face to convey worry about the debt? Or would they remember Bachmann's screen, which showed bar graphs and patriotic images behind her? At one point, she showed the iconic photo of Marines raising an American flag over Iwo Jima in World War II.

I don't think many people would worry about their own political point of view getting too much uninterrupted TV time.

The trucks won't load themselves... morning links 1.26.2011

CNN is the only network airing Rep. Michele Bachmann's "Tea Party" response to the President's State of the Union tonight. That's in addition to the usual opposition party response, being given this time by Rep. Paul Ryan (R-WI).

Reminds me of how back during the Bush years CNN would air a special SOTU response from the left-wing of the Democratic Party. Was it Bernie Sanders or Russ Feingold who did it? I forget. Oh, wait ... no, that never happened.

--David Kurtz TPM

Vermont Measure Calls for Revoking Corporate Personhood

Judge Upholds Gun Ban

A federal judge has upheld Georgia's law banning guns in churches and other places of worship.U.S. District Judge Ashley Royal on Monday dismissed a lawsuit that challenged the law. Royal wrote that Georgia's law does not violate constitutional rights to freedom of religion or bearing arms

I blame "Liberal Media Bias"

CNN is the only network airing Rep. Michele Bachmann's "Tea Party" response to the President's State of the Union tonight. That's in addition to the usual opposition party response, being given this time by Rep. Paul Ryan (R-WI).

Reminds me of how back during the Bush years CNN would air a special SOTU response from the left-wing of the Democratic Party. Was it Bernie Sanders or Russ Feingold who did it? I forget. Oh, wait ... no, that never happened.

Vermont Measure Calls for Revoking Corporate Personhood

Why Americans think Obama is too liberal

Whe[n] Obama was denied bipartisan support, people worried about liberal overreach. But his bipartisan successes have suddenly persuaded the public that he is more moderate. And yet his fundamental approach -- combine center-left and Republican solutions -- has been more or less the same throughout. He offered deals on health reform, just like on taxes. But they were rejected. The main difference is that Republicans signed on to the post-election initiatives, making them look "moderate" in comparison to the previous ones.

President Romney would have provided support to troubled banks--capital injections and stress tests--but he would have avoided even a few targeted nationalizations of the banking system: he is, after all, a Republican.

He would not have pushed the Treasury to engage in large-scale quantitative easing through the Public-Private Investment Program or large-scale mortgage restructuring through the HAMP home mortgage modification program.

On monetary policy, Romney would most likely have reappointed Ben Bernanke and let the Federal Reserve proceed as it wished. On fiscal policy, Romney's Chairman of the Council of Economic Advisers, Mark Zandi, and his National Economic Council Director Douglas Holtz-Eakin would have proposed a fiscal stimulus package that was 60 percent tax cuts and 40 percent spending increases. The Democratic Congress would then have bargained with the administration to produce a stimulus that was 40 percent tax cuts and 60 percent spending.

But, of course, all these policies are exactly what Obama and the Democratic Congress actually enacted.

On global warming, Romney would have abandoned economists' preferred Pigovian carbon tax for the complicated, corporatist and business-friendlier approach of a cap-and-trade system; but he would have been no more successful than Obama in assembling a Senate coalition to achieve anything.

On healthcare, Romney would have taken his signature Massachusetts health care reform and expanded it nationwide: we would have RomneyCare. But that is precisely what we do have.

I see only two key policy differences between RomneyWorld and ObamaWorld. Had Romney been elected President in 2008 we would not have repealed the military policy of "Don't Ask, Don't Tell." And had Romney been elected President in 2008, Elizabeth Warren would not now be Assistant to the President for Consumer Financial Protection.

Otherwise? As far as policy is concerned, we would be smack on the mark that we are on now.

Tuesday, January 25, 2011

Cut Social Security benefits or Raise Payroll Cap... Tea Party folks say raise the roof...

Israel, Foreign Aid, and Fiscal Conservatives....

President Obama called Mr. Mubarak last week, after the uprising in Tunisia, to offer reassurance. But on Tuesday, the White House warned Hezbollah against coercion and intimidation, and officials said the United States might go as far as pulling hundreds of millions of dollars of aid from Lebanon. The administration sent a senior diplomat, Jeffrey D. Feltman, to Tunisia to express support for pro-democracy forces as they prepared for elections after the ouster of President Zine el-Abidine Ben Ali.

Monday, January 24, 2011

pardon the lack of posting but the real world calls...

Wednesday, January 19, 2011

President [blank] Harrison and my pathetic historical proficiency

The initiative for a new federal law to deal with trusts came from President Harrison, who won election in 1888 by claiming the Republicans would find ways to compel competition while at the sme time raising protective tarrifs. Although Congress introduced

Born in 1833 on a farm by the Ohio River below Cincinnati, Harrison attended Miami University in Ohio and read law in Cincinnati. He moved to Indianapolis, where he practiced law and campaigned for the Republican Party. He married Caroline Lavinia Scott in 1853. After the Civil War--he was Colonel of the 70th Volunteer Infantry--Harrison became a pillar of Indianapolis, enhancing his reputation as a brilliant lawyer.

The Democrats defeated him for Governor of Indiana in 1876 by unfairly stigmatizing him as "Kid Gloves" Harrison. In the 1880's he served in the United States Senate, where he championed Indians. homesteaders, and Civil War veterans.

In the Presidential election, Harrison received 100,000 fewer popular votes than Cleveland, but carried the Electoral College 233 to 168. Although Harrison had made no political bargains, his supporters had given innumerable pledges upon his behalf.

When Boss Matt Quay of Pennsylvania heard that Harrison ascribed his narrow victory to Providence, Quay exclaimed that Harrison would never know "how close a number of men were compelled to approach... the penitentiary to make him President."

Harrison was proud of the vigorous foreign policy which he helped shape. The first Pan American Congress met in Washington in 1889, establishing an information center which later became the Pan American Union. At the end of his administration Harrison submitted to the Senate a treaty to annex Hawaii; to his disappointment, President Cleveland later withdrew it.

Substantial appropriation bills were signed by Harrison for internal improvements, naval expansion, and subsidies for steamship lines. For the first time except in war, Congress appropriated a billion dollars. When critics attacked "the billion-dollar Congress," Speaker Thomas B. Reed replied, "This is a billion-dollar country." President Harrison also signed the Sherman Anti-Trust Act "to protect trade and commerce against unlawful restraints and monopolies," the first Federal act attempting to regulate trusts.

The most perplexing domestic problem Harrison faced was the tariff issue. The high tariff rates in effect had created a surplus of money in the Treasury. Low-tariff advocates argued that the surplus was hurting business. Republican leaders in Congress successfully met the challenge. Representative William McKinley and Senator Nelson W. Aldrich framed a still higher tariff bill; some rates were intentionally prohibitive.

Harrison tried to make the tariff more acceptable by writing in reciprocity provisions. To cope with the Treasury surplus, the tariff was removed from imported raw sugar; sugar growers within the United States were given two cents a pound bounty on their production.

Long before the end of the Harrison Administration, the Treasury surplus had evaporated, and prosperity seemed about to disappear as well. Congressional elections in 1890 went stingingly against the Republicans, and party leaders decided to abandon President Harrison although he had cooperated with Congress on party legislation. Nevertheless, his party renominated him in 1892, but he was defeated by Cleveland.

I can now, in good conscience, go back to learning about the Sherman Act...

Tuesday, January 11, 2011

Monday, January 10, 2011

Economics and Morality

If you stick me down in the middle of Bangladesh or Peru...you'll find out how much this talent is going to produce in the wrong kind of soil.

The first thing one should say is that our system does reward hard work, up to a point. Other things equal, those who put more in will earn more.

But a lot of other things are, in fact, not remotely equal. These days, America is the advanced nation with the least social mobility (pdf), except possibly for Britain. Access to good schools, good health care, and job opportunities depends on lot on choosing the right parents.

So when you hear conservatives talk about how our goal should be equality of opportunity, not equality of outcomes, your first response should be that if they really believe in equality of opportunity, they must be in favor of radical changes in American society. For our society does not, in fact, produce anything like equal opportunity (in part because it produces such unequal outcomes). Tell me how you’re going to produce a huge improvement in the quality of public schools, how you’re going to provide universal health care (for parents as well as children, because parents in bad health affect childrens’ prospects), and then come back to me about the equal chances at the starting line thing.

Now, inequality of opportunity is only one reason for the inequality in outcomes we actually see. But of what remains, how much reflects individual effort, how much reflects talent, and how much sheer luck? No reasonable person would deny that there’s a lot of luck involved. Wall Street titans are, no doubt, smart guys (although talking to some of them, you have to wonder …), but there are surely equally smart guys who for whatever reason never got a chance to grab the 9-figure brass ring.

So economics is not a morality play; the social and economic order we have doesn’t represent the playing out of some kind of deep moral principles.

That doesn’t mean the order we have should be overthrown: the pursuit of Utopia, of perfect economic justice, has proved to be the road to hell, while welfare-state capitalism — a market economy with its rough edges smoothed by a strong safety net — has produced the most decent societies ever known. The point, though, is that anyone who claims that transferring some income from the most fortunate members of society to the least is a vile injustice is closing his eyes to the obvious reality of how the world works.

Sunday, January 9, 2011

You probably need a bigger circle of friends...

if spending cuts—meaning actual, concrete cutting of specific programs as opposed to vague talk about “spending cuts”—are popular, then what’s the explanation for why they’re so rare?

each and every one of us in this room can find some government program or service that obviously needs to be cut. I can stand here in front of you and say that we have to cut that program. We can all shake our heads and nod and the obviousness of this. But if I can't go up to the Gold Dome and find the votes needed to cut those programs its not because of some massive conspiracy, or because politicians aren't listening to you. Its because we can't get the votes. That's not a conspiracy, or bad government, thats Democracy.

Thursday, January 6, 2011

ObamaCare the radical left wing health care refrom...

The health-care law the president signed was modeled off of the health-care law the Republican governor of Massachusetts had signed, which was in turn modeled off of the health-care law the Republicans in Congress had proposed in 1993. That's "left"?

Lessons from the campiagn trail: Political Discourse

Corporate Tax Schemes

Tuesday, January 4, 2011

Citizenship for Babies Looms as Immigration Fight

Health Care Reform---high risk pools aren't working....

The United States has actually defaulted on its debt obligations before.

Embracing Regulatory Capture

The phenomenon of “regulatory capture” wherein private interests seize control of the policymaking apparatus for their own interests is a real one. And it’s a significant problem for progressive policy, and conservative critics of progressive reform often wield it as part of the rhetoric of reaction. But one of the biggest flaws with the conservative movement in America, and thus one of the biggest impediments to making American public policy better, is that instead of using its acute awareness of this problem to focus on ameliorating it, conservatives consistently act to deliberately make it worse.

Today’s profile in shame, Representative Darryl Issa of California:

Rep. Darrell Issa (R-Calif.) wants the oil industry, drug manufacturers and other trade groups and companies to tell him which Obama administration regulations to target this year.

The incoming chairman of the House Oversight and Government Reform Committee – in letters sent to more than 150 trade associations, companies and think tanks last month – requested a list of existing and proposed regulations that would harm job growth.

[...]

But a partial list obtained by POLITICO includes ones sent Dec. 13 to Duke Energy, the Association of American Railroads, FMC Corp., Toyota and Bayer. Others receiving inquiries from Issa over the course of the month included the American Petroleum Institute, National Association of Manufacturers (NAM), the National Petrochemical & Refiners Association (NPRA) and entities representing health care and telecommunication providers.

This is why we can’t have nice things.

Quote of the day--- Groundhog Day and Hegel's Phenomenology...

Groundhog Day is just a rewrite of Hegel’s Phenomenology on the theory that Andy McDowell is even more awesomely desirable than Prussian bureaucracy, or whatever Hegel decided was best

Monday, January 3, 2011

Democratic capitalism, a regulated species of capitalism...

The Industrial Revolution in England marked the emergence of capitalism, which organizes economic activity around markets and places central decision power in the hands of those representing capital. The corporation shows the capitalist form, with shareholders as residual claimants running the show. In the modern age, the central power is tempered by governmental political power through democratic capitalism. Here, democratic political power--operating from a "one person, one vote" principle--restrains the economic power of businesses. Through legislative and executive political institutions, governmental regulatory functions are defined and put into effect to produce a regulated species of capitalism.

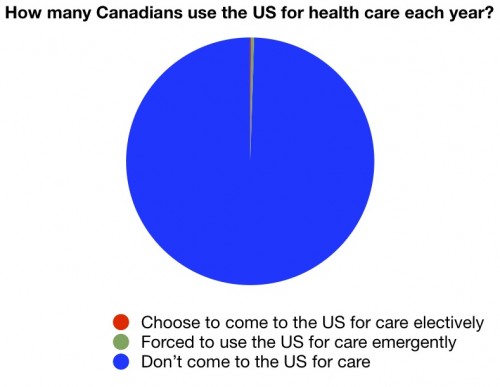

How many Canadians use the US for health care each year?

As always, when we can we should turn to evidence and research, and on this topic it does exist. The most comprehensive work I’ve seen on this topic was published in a manuscript in the peer-reviewed journal Health Affairs. That study looked at how Canadians cross the border for care. Most anecdotes involve Canadians, since it’s easy for those on the border to come here. And, the authors used a number of different methods to try and answer the question*:

1) First, they surveyed United States border facilities in Michigan, New York, and Washington. It makes sense that Canadians crossing the border for care would favor sites close by, right? It turns out that about 80% of such facilities saw fewer than one Canadian per month. About 40% saw none in the prior year. And when looking at the reasons for visits, more than 80% were emergencies or urgent visits (ie tourists who had to go to the ER). Only about 19% of those already few visits were for elective purposes.

2) Next, they surveyed “America’s Best Hospitals”, because if Canadians were going to travel for care, they would be more likely to go to the most well-known and highest quality facilities, right? Only one of the surveyed hospitals saw more than 60 Canadians in one year. And, again, that included both emergencies and elective care.

3) Finally, they examined data from the 18,000 Canadians who participated in the National Population Health Survey. In the previous year, only 90 of those 18,000 Canadians had received care in the United States; only 20 of them had done so electively.

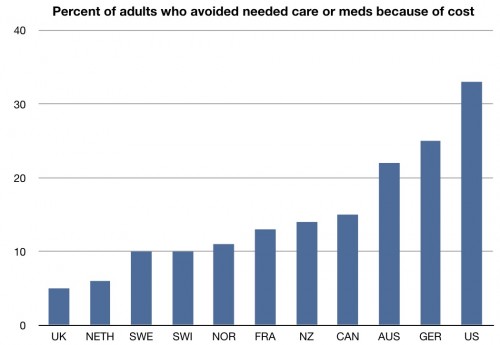

About one third of Americans report that they didn’t go to the doctor when sick, didn’t get recommended care when needed, did not fill a prescription, or skipped doses of medications in the last year because of cost.

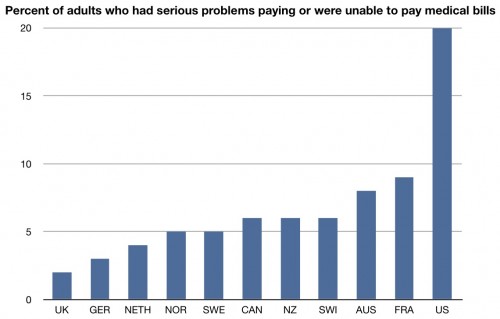

Finally, about one in five Americans had serious problems paying or were unable to pay medical bills in the last year. This is more than twice the percentage seen in any of the other countries.

It’s data like these that make me want to scream every time someone blithely says that we have the “best health care system in the world.” This is more than just the uninsured; significant numbers of people in this country have trouble getting care because of cost. And remember – we are spending WAY more than any other country already, and for all that money we’re getting middling to crappy results.

Why would anyone want to keep this going unchanged?

Amen....

Nietzsche bio

Nietzsche was born in Rocken, a village in Prussian Saxony, in 1844. His father and both grandfathers were Lutheran pastors and as a boy he was a pious believer. He attended Pforta school, the Rugby of Prussia, from 1858 to 1864 and then went to Bonn and subsequently Leipzig University (1864-9). At Bonn he studied theology but gave it up when he lost his religious faith; he continued as a student of philology and gained so great a reputation in it that he was appointed to the chair of classical philology at Basel University at the age of 24 before having obtained his doctorate, which was awarded him by Leipzig without examination. He taught at Basel for ten years (1869-79), becoming a Swiss to do so, and published his earliest books: The Birth of Tragedy (1872) and the four Untimely Meditations (1873-6). He also became a 'disciple' of Richard Wagner and devoted much time and energy to assisting in establishing the Bayreuth Festival, which was inaugurated in 1876. But by that time Nietzsche had come to think he had been mistaken in seeing in Wagner the new savior of German art, and this disillusionment, combined with his sense that the newly established Reich was a victory for philistinianism, turned him against all things German and he became year by year more critical of the 'new Germany'

Obama and the 111th Congress' biggest failure...

That something needs to be done is pretty clear. Wall Street veteran Henry Kaufman made the case (registration required) the other day in the Financial Times. The Dodd-Frank Act did nothing about the extraordinary concentration of assets that had taken place, he noted. The ten biggest institutions share of assets grew from 10 percent in 1990 to well over 70 percent today. Future failures could only increase that concentration, just as they did last fall. Where else to put the assets of a failed bank but in the hands of the other giants? Small banks will be squeezed further in the years ahead, competition will decrease, volatility and risk-taking will increase, wrote Kaufman, until in the end there will be no choice but to recreate a system with a large number of smaller institutions no longer deemed too-large-to-fail.

Nearly one of every four high school graduates can't pass the basic military entrance exam

Anybody that cares about the long term deficits our nation face...

- When budget surpluses were projected 10 years ago, this was described by Republicans as a policy problem to be solved by tax cuts.

- When Republicans controlled the government, they consistently acted to make deficits larger.

- Republicans opposed the deficit-reducing Affordable Care Act.

- Republicans opposed the deficit-reducing American Climate and Energy Security Act.

- Republicans opposed the deficit-reducing DREAM Act.

- When Barack Obama proposed some deficit-increasing tax cuts, Republicans insisted that they would go along if and only if he added additional deficit increasing tax cuts.

- Republicans are planning to replace deficit-mitigating PAYGO rules with deficit increasing CUTGO rules.