On the straight economics, the tax deal is worth doing. But the history of the past two years drives home, if anyone doubted it, that economic policy must be considered from a political economy point of view; that you have to think ahead to how current policies affect the environment in which future policies will be decided. And the more I work on this, the more concerned I’m becoming.

We already knew that extending the Bush tax cuts makes it more likely that they’ll be made permanent — which increases the costs of doing a deal beyond the direct budget impact. That is, we knew that any deal extending those tax cuts for two years means that we can expect a replay of December 2010 in December 2012, with a high chance of a bad result.

But the new deal creates another hostage situation — this time for December 2011, when the good stuff in the deal is scheduled to run out.

Look at the Zandi estimates: they show a boost to the economy in 2011, which is then given back in 2012. So growth is actually slower in 2012 than it would be without the deal.

Now, what we know from lots of political economy research — Larry Bartels is my guru on this — is that presidential elections depend, not on the state of the economy, but on whether things are getting better or worse in the year or so before the election. The unemployment rate in October 1984 was almost the same as the rate in October 1980 — but Carter was thrown out by voters who saw things getting worse, while for Reagan it was morning in America.

Put these two observations together — and what you get is that the tax-cut deal makes Obama’s reelection less likely. Let me repeat: the tax cut deal makes Obama less likely to win in 2012.

OK, so what? Think about the dynamics that sets up for December 2011. The Democratic parts of the deal will be on the verge of expiring, while the Republican parts will have another year to run. Won’t that put the Dems in a desperate position? Won’t Obama be strongly tempted to make further big concessions to get something to boost the economy for another year?

What could change this outlook? The hostage situation won’t materialize if the new stuff “jump-starts” recovery, so that the economy is on solid footing by a year from now. But as I’ve argued in the past, and continue to believe, this is a bad metaphor.

So there are real reasons to worry here. Obama may be buying off the hostage-takers by … giving them more hostages.

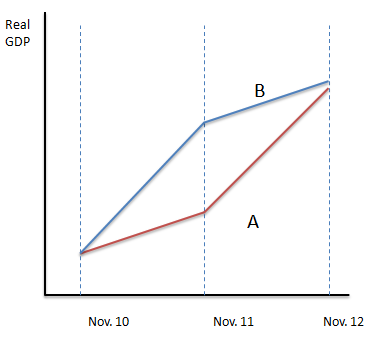

Consider two possible paths for the economy over the period November 2010 to November 2012:

Clearly, path B is better than path A: GDP is higher throughout, including at the end of the two-year period. But the political science literature is very clear: path B is also worse than path A for the incumbent party. The growth rate in that final year (or possibly even less than that) — represented here by the slope of the line — is what matters. So better to have a worse economy and a late upturn than a better economy but lower growth in the final stretch.

Anyone who’s read the classic Larry Bartels paper on politics and the income distribution (pdf) should know this; one of the key points in that paper is that Republicans have fared better than Democrats, even though they have generally presided over worse economic performance, because they tend to have faster growth in year that precedes an election.

And the Zandi estimates of the tax-cut deal basically have us going from A to B.

It’s outrageous — but it’s also what the evidence says.

With unemployment still over 7% in 2012 and a front loaded stimulus that begins to slow by that point my hunch is that only Sarah Palin will save Obama's chances. But I could be wrong as there are lots of contingency factors between now and then.

No comments:

Post a Comment