On Wall Street and on Silicon Valley office campuses, in hedge fund boardrooms and at year-end Christmas parties, it seems you can’t have a conversation without someone talking about the movie that finally lays bare America’s public education crisis.

“Waiting for ‘Superman’ ” is one thing that Bill Gates, Steve Jobs and Mark Zuckerberg agree on, Rupert Murdoch talks about to anyone who will listen, David Koch of Koch Industries promotes, and Paul Tudor Jones and many of his hedge fund brethren work to support.

“Waiting for ‘Superman’ ” follows five children and their parents as they run a gantlet to gain access to high-performing charter schools because the alternative — the public system — is a complete disaster. The film has caught the imagination of the business community because it represents a reckoning for public education and its chronic failures, making the very businesslike case that large school systems and the unions that go with them must be replaced by a customized, semi-privatized education in the form of charter schools.

Which is odd when you think about it. If you are looking for an American institution that failed the public, made resources disappear without returning value and lacked accountability for its manifest sins, the Education Department would be in line well behind Wall Street.

By now, the notion that business is a place built on accountability and performance should be as outdated as the one-room schoolhouse. Ask yourself, what would happen if American public schools were offered hundreds of billions in bailout money? One outcome is not in the cards: its leaders would not end up back at the trough so quickly, sucking up tens of millions in bonuses as Wall Street has.

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Thursday, December 30, 2010

Waiting for Superman reality check...

Wednesday, December 29, 2010

The 30 year rightward trend...

The sad fact remains, though, that the "center" of American politics (except with respect to discrimination against minority groups) has moved steadily to the right for thirty years, so much so that the center of the Demoractic party would have been Nixon Republicans in 1970, and the Republican Party is squarely where the unhinged reactionary right was two generations ago. If that trend continues, things can only end very badly for this country.

Withdrawl from Iraq; end of an era...

No one is arguing that the peculiar, behind-the-scenes sort of American empire is ending with the withdrawal from Iraq. What is ending is George W. Bush’s departure into expensive and anachronistic games of direct imperial domination.

Thursday, December 23, 2010

Wednesday, December 22, 2010

What's this you say? Black people in England?

Shortly before I first came here some fifteen years ago, I asked a local how people would react to a black man with a British accent. "When they hear your voice, they'll add twenty points to your IQ," he said. "But when they see your face, they won't."

With some white conservatives, I've noticed, the gulf between what they see and what they hear can widen into an unbridgeable chasm. The affect of Englishness—hauteur, refined behavior and aristocracy (none of which I possess)—is something they aspire to, or at least appreciate. Blackness, on the other hand, is not.

And so when I introduce myself as a journalist from England I occasionally prompt a moment of synaptic dysfunction. The overwhelming majority get over it. But every now and then they say, "Really? I don't hear an accent."

"If you beat your head against the wall," the Italian Marxist Antonio Gramsci once wrote, "it is your head that breaks, not the wall."

To avoid an almighty headache I try to shut the conversation down: "Well, I can't explain that. But let's get on with the interview."

But they won't let it go. "Where in England?" "Were you born there?" "How long have you been here?"

The sad truth is that even when presented with concrete and irrefutable evidence, some people still prefer the reality they want over the one they actually live in. Herein lies one of the central problems of engaging with those on the American right. Cocooned in their own mediated ecosystem, many of them are almost unreachable through debate; the air is so fetid, reasonable discussion cannot breathe. You can't win an argument without facts, and we live in a moment when whether you're talking about climate change or WMD, facts seem to matter less and less.

Monday, December 20, 2010

Naomi Wolf on the Sexual Allegations Against Julian Assange

If you read these allegations, he took off Miss A’s clothes too quickly for her comfort. She tried to tell him to slow down, but then, quote, "she allowed him to undress her." This is what the report says. The second woman says she woke to find him having sex with her. When she asked whether he was wearing a condom, he said no. Quote, "According to her statement, she said: 'You better not have HIV.'" He answered, "Of course not." Quote, "She couldn’t be bothered to tell him one more time because she had been going on about the condom all night. She had never had unprotected sex before."

So, if you’re going to treat women as moral adults and if you’re going to take the issue of rape seriously, the person who’s engaging in what he thinks is consensual sex has to be told, "I don’t want this." And again and again and again, these women did not say, "This is not consensual." Assange was shocked when these were brought up as complaints, because he had no idea that this was not a consensual situation. Miss A kept Assange in her home for the next four days and threw a party for him.

So, because I take rape seriously, because I’m aware that in 23 years, you know, in Sweden, which has been criticized by Amnesty International for disregarding rape, for letting rapists go free, because you have a better chance in Sweden, if you’re a rape victim, of, you know, dying in an accident or getting breast cancer than having a serious rape allegation prosecuted or getting any kind of legal hearing, according to Amnesty International’s report "Case Closed"—it’s because of that that I know that these charges are utterly, utterly atypically handled. In 23 years, I’ve never seen any man in any situation this ambiguous, involving this much consent, have any kind of legal process whatsoever. And all over the world, women who have been gang-raped, brutally raped, raped in alleyways, pimped, prostituted, trafficked, you know, their rapists go free.

So, yes, this stinks to me. And yes, it’s about politics, and it’s about the same kind of politics that dragged you, when you were trying to cover a march, you know, violently into legal jeopardy, because really this is about a journalist who has angered the most powerful and increasingly brutal nation on earth, and it’s about all of us who are journalists being dragged into a dangerous situation because of criticism of the government.

Joe Biden, Julian Assange, and if/then statements...

Friday, December 17, 2010

The trucks won't load themselves... 12/17/2010

I had come here to shoot at ‘Fascists’; but a man who is holding up his trousers isn't a ‘Fascist’, he is visibly a fellow-creature, similar to yourself, and you don't feel like shooting at him.

Karl Rove no longer runs the GOP. Winston Smith does.

larger significance of the party's shift. It wasn't too long ago -- within the last decade -- that there was a basic spectrum of policy positions Republicans accepted on a range of national issues. Not every candidate agreed across the board with every position, but the GOP's general approach was fairly easy to identify.On health care, for example, the Republican mainstream envisioned a system involving an individual mandate. On arms control, the Republican mainstream embraced policies along the lines of the original START treaty.

And on energy policy, the Republican mainstream loved cap and trade. Indeed, just two years ago, the ticket of John McCain and Sarah Palin vowed to establish "a cap-and-trade system that would reduce greenhouse gas emissions" and pursue "alternatives to carbon-based fuels."

The point, of course, isn't just that the Republican mainstream has shifted sharply to the right, it's that the mainstream has fallen off a right-wing cliff with surprising speed. Positions that were widely accepted by Republicans just a few years ago are now considered communist plots to destroy the American way of life.

Thursday, December 16, 2010

The Bond Market and Interest Rates

A security (also called a financial instrument) is a claim on the issuer's future income or assets (any financial claim or piece of property that is subject to ownership). A bond is a debt secruity that promises to make payments periodically for a specified period of time. The bond market is especially important to economic activity because it enables corporations and governments to borrow to finance their activities and because it is where interest rates are determined. An interest rate is the cost of borrowing or price paid for the rental of funds (usually expressed as a percentage of the rental of $100 per year) There are many interest rates in the economy--mortgage interest rates, car loan rates, and interest rates on many different types of bonds.Interest rates are important on a number of levels. On a personal level, high interest rates could deter you from buying a hourse or a car because the cost of financing it would be high. Conversely, high interest rates could encourage you to save because you can earn more interest income by putting aside some of your earnings as savings. On a more general level, interest rates have an impact on the overall health of the economy because they affect not only consumers willingness to spend or save but also businesses' investment decisions. High interest rates, for example, might cause a corporation to postpone building a new plant that would provide more jobs.Because changes in interest rates have important effects on individuals, financial institutions, businesses, and the overall economy, it is important to explain fluctuations in interest rates that have been substantial over the past 30 years. For example, the interest rate on three-month Treasury bills peaked at over 16% in 1981. The interest rate fell to 3% in late 1992 and 1993, rose to above 5% in the mid-to late 90's, fell below 1% in 2004, rose to 5% by 2007, only to fall to zero in 2008.Because different interest rates have a tendency to move in unison, economists frequently lump interest rates together and refer to "the" interest rate... however interest rates on several types of bonds can differ substantially. The interest rate on three-month Treasury bills, for example, fluctuates more than the other interest rates and is lower, on average. The interest rate on Baa (medium-quality) corporate bonds is higher, on average, than the other interest rates, and the spread between it and the other rates became larger in the 1970's, narrowed in the 1990's, and rose briefly in the early 2000's, narrowed again, only to rise sharply starting in the summer of 2007.

Wednesday, December 15, 2010

The trucks won't load themselves 12/15/2010

Our point of view is government decreases the ability for this company, for this country to have um, economic freedom

Tuesday, December 14, 2010

Core Inflation: why do we need it and how should it be measured?

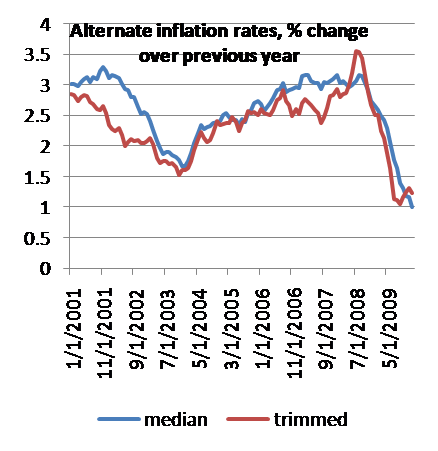

So: core inflation is usually measured by taking food and energy out of the price index; but there are alternative measures, like trimmed-mean and median inflation, which are getting increasing attention.

First, let me clear up a couple of misconceptions. Core inflation is not used for things like calculating cost-of-living adjustments for Social Security; those use the regular CPI.

And people who say things like “That’s a stupid concept — people have to spend money on food and gas, so they should be in your inflation measures” are missing the point. Core inflation isn’t supposed to measure the cost of living, it’s supposed to measure something else: inflation inertia.

Think about it this way. Some prices in the economy fluctuate all the time in the face of supply and demand; food and fuel are the obvious examples. Many prices, however, don’t fluctuate this way — they’re set by oligopolistic firms, or negotiated in long-term contracts, so they’re only revised at intervals ranging from months to years. Many wages are set the same way.

The key thing about these less flexible prices — the insight that got Ned Phelps his Nobel — is that because they aren’t revised very often, they’re set with future inflation in mind. Suppose that I’m setting my price for the next year, and that I expect the overall level of prices — including things like the average price of competing goods — to rise 10 percent over the course of the year. Then I’m probably going to set my price about 5 percent higher than I would if I were only taking current conditions into account.

And that’s not the whole story: because temporarily fixed prices are only revised at intervals, their resets often involve catchup. Again, suppose that I set my prices once a year, and there’s an overall inflation rate of 10 percent. Then at the time I reset my prices, they’ll probably be about 5 percent lower than they “should” be; add that effect to the anticipation of future inflation, and I’ll probably mark up my price by 10 percent — even if supply and demand are more or less balanced right now.

Now imagine an economy in which everyone is doing this. What this tells us is that inflation tends to be self-perpetuating, unless there’s a big excess of either supply or demand. In particular, once expectations of, say, persistent 10 percent inflation have become “embedded” in the economy, it will take a major period of slack — years of high unemployment — to get that rate down. Case in point: the extremely expensive disinflation of the early 1980s.

Now, the measurement issue: we’d like to keep track of this sort of inflation inertia, both on the upside and on the downside — because just as embedded inflation is hard to get rid of, so is embedded deflation (ask the Japanese). But in the real world, while some (many) goods behave like this, some don’t: their prices rise quickly with supply and demand changes, and don’t display inertia. So we need a measure that extracts the signal from the noise, getting at the inertial part of the story.

The standard measure tries to do this by excluding the obviously non-inertial prices: food and energy. But are they the whole story? Of course not — and standard core measures have been behaving a bit erratically lately. Hence the growing preference among many economists for measures like medians and trimmed means, which exclude prices that move by a lot in any given month, presumably therefore isolating the prices that move sluggishly, which is what we want.

And what these measures show is an ongoing process of disinflation that could, in not too long, turn into outright deflation:

File under "go figure": Markets aren't fortune tellers....

There is a phrase that goes something like "the stock market has predicted 9 out of the last 3 recessions.” The bond market is guilty of the same thing, predicting at least 2 out of the last 0 recoveries. Now that the gospel of efficient markets is taught in business schools far and wide, not just Wharton, there can be a tendency to think that every move in the markets is predicting the future. Isn’t that why stock prices have a heavier weighting than, say, manufacturers’ new orders in the Conference Board’s index of leading economic indicators?

Markets aren’t fortune tellers. Markets measure expectations of the future, and those expectations change as the available information changes.

The trucks won't load themselves 12/14/2010 edition...

David Altig over at Macroblog asks, what might monetary policy success look like? Also take a look at his recent oped in the AJC, Federal Reserve policies focused, where he focused on some of the concerns people have about Qe2.

.. what is largely absent from this debate is discussion of the war, which includes military actions in Afghanistan, Iraq, Yemen, allied Pakistan, military exercises in the Yellow Sea and elsewhere, and the maintenance of over 800 U.S. military bases throughout the world. To put the latter into perspective, Great Britain and Ancient Rome, at the very height of their Empires, never had more than 40 military bases internationally.

James A. Nichols IV

cell: (770) 312-6736

www.JimN2010.com

www.JimNichols4.com"Nothing in the world can take the place of Persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan 'Press On' has solved and always will solve the problems of the human race." ---Calvin Coolidge (1872 - 1933)

"Wovon man nicht sprechen kann, darüber muß man schweigen." --Lugwig Wittgenstein Logische-Philosophische Abhandlung 7

"Government as household" analogy...

The “government as household” analogy, which persistently interposes itself on the deficit dove or hawk paradigm, is fundamentally flawed because no household (or firm) is able to spend by crediting bank deposits and reserves, or by issuing currency. Households and firms can spend by going into debt, but the debt must be serviced with the debt of another—usually a bank debt. Sovereign government only makes payments—including interest payments on its debt—by issuing its own IOU. This is why it is ludicrous to speak of Social Security as some sort of “Ponzi scheme”, because unlike private debtors the sovereign government can always make payments and service debt by crediting bank accounts.

What Does an Unmanaged Macroeconomy Look Like?

Brad Delong looks back and asks what does an unmanaged macroeconomy look like? He finds the US to be one of the only natural experiments on this question....

what does an economy without effective macroeconomic regulation look like?We do not have all that many examples. Britain's Bank of England started regulating the macroeconomy in response to the industrial business cycle back in 1825. The Bank of France was not far behind. Almost as soon as a country had a capital-intensive industrial sector capable of generating a modern business cycle, it had a central bank to stabilize its macroeconomy.

The U.S. was an exception. It lost its proto-central bank to Andrew Jackson in the 1830s. It did not acquire a central bank until 1913--and the central bank had no clue what to do in a recession after the death of Benjamin Strong in 1928. The pre-World War II U.S. was as close to an economy without effective macroeconomic regulation as we have--and even there we have occasional monetary and banking policy conducted by the pickup central banks that were the House of Morgan in 1907 and the Belmont-Morgan syndicate in 1895. It was the passage of the Employment Act of 1946 that marked the start of systematic stabilization policy in the United States.

And, at least from the perspective of the metric that is the non-farm unemployment rate--the agricultural sector does not have an industrial business cycle, after all--there is no evidence that macroeconomic management has not been vastly better than the alternative.

Monday, December 13, 2010

How Will the Nutrition Bill Change School Lunches?

. The bill increases federal funding for school lunches - by about six cents per meal - for the first time in more than three decades.The child nutrition legislation, which was approved unanimously in the Senate in August and recently passed the House by a vote of 264 to 157, gives the Secretary of Agriculture the power to set standards for foods sold in schools, including items in "a la carte" lines and vending machines. The legislation also combats child hunger by making more than 100,000 children on Medicaid eligible for free lunches.

A controversial provision in the law regulates the price of lunches served to children from families that earn more than 185 percent of the poverty level. The Congressional Budget Office has said this provision will require some schools to raise their meal prices.

Margo Wootan, Director of Nutrition Policy at the Center for Science in the Public Interest, says that while definitive nutrition standards are yet to be determined by the Department of Agriculture, the bill represents a major change for the quality of food in the nation's schools.

"This child nutrition bill gets a lot of junk food out of schools and a lot of healthier food into schools," said Wootan. "It is a historic step toward reducing childhood obesity and helping parents feed their children better."

Global shift taking place

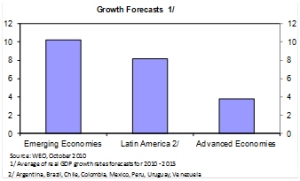

The financial crisis has marked what may be seen by future generations as a moment of profound transformation in the world economy. So-called emerging market countries are coming to the fore, both as sources of global growth going forward, but also by taking on an increasing role in global governance, including through representation at the IMF.

Latin America is a key part of this change, with fast growing economies such as Brazil, Chile and Peru providing important support to the global recovery, but also benefiting from increasing trade links with fast-growing Asian countries. This transformation creates challenges, such as managing the pace of growth and the flow of capital to emerging markets. But it also creates opportunities to achieve a sustained rise in living standards in these countries.

Breaking News: Free riding on taxpayer dollars constitutional

7 incoming GOP leaders rode wave of PAC gifts into power

Moderate GOP stimulus... both economic and political...

On the straight economics, the tax deal is worth doing. But the history of the past two years drives home, if anyone doubted it, that economic policy must be considered from a political economy point of view; that you have to think ahead to how current policies affect the environment in which future policies will be decided. And the more I work on this, the more concerned I’m becoming.

We already knew that extending the Bush tax cuts makes it more likely that they’ll be made permanent — which increases the costs of doing a deal beyond the direct budget impact. That is, we knew that any deal extending those tax cuts for two years means that we can expect a replay of December 2010 in December 2012, with a high chance of a bad result.

But the new deal creates another hostage situation — this time for December 2011, when the good stuff in the deal is scheduled to run out.

Look at the Zandi estimates: they show a boost to the economy in 2011, which is then given back in 2012. So growth is actually slower in 2012 than it would be without the deal.

Now, what we know from lots of political economy research — Larry Bartels is my guru on this — is that presidential elections depend, not on the state of the economy, but on whether things are getting better or worse in the year or so before the election. The unemployment rate in October 1984 was almost the same as the rate in October 1980 — but Carter was thrown out by voters who saw things getting worse, while for Reagan it was morning in America.

Put these two observations together — and what you get is that the tax-cut deal makes Obama’s reelection less likely. Let me repeat: the tax cut deal makes Obama less likely to win in 2012.

OK, so what? Think about the dynamics that sets up for December 2011. The Democratic parts of the deal will be on the verge of expiring, while the Republican parts will have another year to run. Won’t that put the Dems in a desperate position? Won’t Obama be strongly tempted to make further big concessions to get something to boost the economy for another year?

What could change this outlook? The hostage situation won’t materialize if the new stuff “jump-starts” recovery, so that the economy is on solid footing by a year from now. But as I’ve argued in the past, and continue to believe, this is a bad metaphor.

So there are real reasons to worry here. Obama may be buying off the hostage-takers by … giving them more hostages.

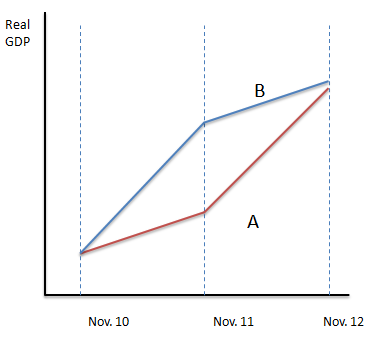

Consider two possible paths for the economy over the period November 2010 to November 2012:

Clearly, path B is better than path A: GDP is higher throughout, including at the end of the two-year period. But the political science literature is very clear: path B is also worse than path A for the incumbent party. The growth rate in that final year (or possibly even less than that) — represented here by the slope of the line — is what matters. So better to have a worse economy and a late upturn than a better economy but lower growth in the final stretch.

Anyone who’s read the classic Larry Bartels paper on politics and the income distribution (pdf) should know this; one of the key points in that paper is that Republicans have fared better than Democrats, even though they have generally presided over worse economic performance, because they tend to have faster growth in year that precedes an election.

And the Zandi estimates of the tax-cut deal basically have us going from A to B.

It’s outrageous — but it’s also what the evidence says.

With unemployment still over 7% in 2012 and a front loaded stimulus that begins to slow by that point my hunch is that only Sarah Palin will save Obama's chances. But I could be wrong as there are lots of contingency factors between now and then.

Glenn Beck claims there are 157,000,000 terrorists in the world

Zakaria’s courage in standing up to the hate-mongers should not be underestimated, and he is among those few now standing in the way of a Rupert Murdoch plot to foment physical attacks of a Ku Klux Klan sort on American Muslims, using his Fox Cable News to spread hate. Leaked memos over the years have repeatedly demonstrated that Fox is a propaganda organ where reporters are routinely instructed how to spin the news to favor the filthy rich and the US Republican Party (there, I’ve been redundant).

Sunday, December 12, 2010

Prisoners Strike in Georgia

In a protest apparently assembled largely through a network of banned cellphones, inmates across at least six prisons in Georgia have been on strike since Thursday, calling for better conditions and compensation, several inmates and an outside advocate said.

Inmates have refused to leave their cells or perform their jobs, in a demonstration that seems to transcend racial and gang factions that do not often cooperate.

“Their general rage found a home among them — common ground — and they set aside their differences to make an incredible statement,” said Elaine Brown, a former Black Panther leader who has taken up the inmates’ cause. She said that different factions’ leaders recruited members to participate, but the movement lacks a definitive torchbearer.

Ms. Brown said thousands of inmates were participating in the strike.

The prisoner strike in Georgia is unique, sources among inmates and their families say, because it includes not just black prisoners, but Latinos and whites too, a departure from the usual sharp racial divisions that exist behind prison walls. Inmate families and other sources claim that when thousands of prisoners remained in their cells Thursday, authorities responded with violence and intimidation. Tactical officers rampaged through Telfair State Prison destroying inmate personal effects and severely beating at least six prisoners. Inmates in Macon State Prison say authorities cut the prisoners' hot water, and at Telfair the administration shut off heat Thursday when daytime temperatures were in the 30s. Prisoners responded by screening their cells with blankets, keeping prison authorities from performing an accurate count, a crucial aspect of prison operations.

As of Friday, inmates at several prisons say they are committed to continuing the strike. “We are going to ride it,” the inmate press release quotes one, “till the wheels fall off. We want our human rights.”

The peaceful inmate strike is being led from within the prison. Some of those thought to be its leaders have been placed under close confinement.

The nine specific demands made by Georgia's striking prisoners in two press releases pointedly reflect many of the systemic failures of the U.S. regime of mass incarceration, and the utter disconnection of U.S. prisons from any notions of protecting or serving the public interest. Prisoners are demanding, in their own words, decent living conditions, adequate medical care and nutrition, educational and self-improvement opportunities, just parole decisions, just parole decisions, an end to cruel and unusual punishments, and better access to their families.

It's a fact that Georgia prisons skimp on medical care and nutrition behind the walls, and that in Georgia's prisons recreational facilities are non-existent, and there are no educational programs available beyond GED, with the exception of a single program that trains inmates to be Baptist ministers. Inmates know that upon their release they will have no more education than they did when they went in, and will be legally excluded from Pell Grants and most kinds of educational assistance, they and their families potentially locked into a disadvantaged economic status for life.

Despite the single biggest predictor of successful reintegration into society being sustained contact with family and community, Georgia's prison authorities make visits and family contact needlessly difficult and expensive. Georgia no longer allows families to send funds via US postal money orders to inmates. It requires families to send money through J-Pay, a private company that rakes off nearly ten percent of all transfers. Telephone conversations between Georgia prisoners and their families are also a profit centers for another prison contractor, Global Tel-Link which extracts about $55 a month for a weekly 15 minute phone call from cash-strapped families. It's hard to imagine why the state cannot operate reliable payment and phone systems for inmates and their families with public employees at lower cost, except that this would put contractors, who probably make hefty contributions to local politicians out of business.

Besides being big business, prisons are public policy. The U.S. has less than five percent of the world's population, but accounts for almost a quarter of its prisoners. African Americans are one eighth this nation's population, but make up almost half the locked down. The nation's prison population increased more than 450% in a generation beginning about 1981.

Dood-Frank, rent seeking banks, and Republican Scott Brown.

Wasn't it ever thus?

These days, we’re living in the world of the imperial, very self-interested individual; the man in the gray flannel suit has been replaced by the man in the very expensive Armani suit. Look at the protagonists in the global financial meltdown, and you won’t see faceless corporations subverting individual will; you’ll see avaricious individuals exploiting corporate forms to enrich themselves, often bringing the corporations down in the process. Lehman, AIG, Anglo-Irish, etc. were not cases of immortal hive-minds at work; they were cases of kleptocrats run wild.

And when it comes to the subversion of the political process — yes, there are faceless corporations in the mix, but the really dastardly players have names and large individual fortunes; Koch brothers, anyone?

If you ask how it’s possible that a handful of bad actors can get their way so often, the answer has to be, wasn’t it ever thus? What we call civilization has usually been a form of kleptocracy, varying mainly in its efficiency (the Romans were no nicer than the barbarians, just more orderly). Yes, we’ve had a few generations of government somewhat of, by, for the people in some places — but that’s an outlier in the broader sweep of things.

So never mind the hive-minds; good old greed still rules.

Not surprisingly, social policy regularly turns out to be a welfare project for the rich and powerful. Imperial systems, in particular, are one of the many devices by which the poor at home subsidize their masters. And while studies of the cost effectiveness of empire and domination for "the nation" may have academic interest, they are only marginally relevant to the study of policy formation in societies in which the general public is expected to stand aside---that is, all existing societies.

ESTRAGON: Didi? VLADIMIR: Yes. ESTRAGON: I can't go on like this. VLADIMIR: That's what you think.

Monday, December 6, 2010

The two Republican parties...

There are actually two Republican parties in America. One wants to do real deregulation, to actually reduce the role of the government in the economy. The other Republican party (which I fear is the more powerful one) wants to do “deregulation,” to remove all constraints on business, banking, the medical industrial complex, energy, for-profit colleges, etc, so that they can systematically loot the taxpayers by taking advantage of the enormous moral hazard that has seeped into almost all aspects of our modern regulated economy.

The Dems are more likely to want to try to tame the beast, but then keep passing laws that make the economy even more riddled with moral hazard. Not much of a choice these days.

Monday, November 29, 2010

The trucks won't load themselves 11.29.2010 morning links

He attacked everything in life with a mix of extraordinary genius and naive incompetence, and it was often difficult to tell which was which. --Douglas Adams

David Brooks is Upset that the Politicians Are Listening to Voters

The recent improvement in economic news

• The October employment report showed a gain of 151,000 nonfarm payroll jobs, the most since April ex-Census. Expectations are for a similar gain in November, although probably not enough jobs added to push down the unemployment rate. • The BEA estimated real GDP grew at a 2.5% annual rate in Q3. This is still sluggish, but an improvement from the 1.7% growth rate in Q2.• The Personal Income and Outlays report for October indicated incomes grew at a 0.5% rate (month-to-month), and it appears PCE has grown at about a 3% annualized rate over the last three months. The personal saving rate was 5.7% in October, and although I expect the rate to increase a little more - it appears a majority of the adjustment is behind us (a rising saving rate is a drag on personal consumption). • The 4-week average of initial weekly unemployment claims has declined to 436,000 last week from over 480,000 at the end of August. The weekly reading was 407,000 last week; the lowest since July 2008.• Most regional manufacturing surveys, with the exception of the NY Fed survey (empire state), has shown a pickup in manufacturing. This suggests the manufacturing sector is still improving (the ISM manufacturing index for November will be released on Wednesday). • Trucking and rail traffic improved in October, although the Ceridian diesel fuel index was weak. • The Architecture Billings Index (a leading indicator for commercial real estate) is near flat - suggesting investment in commercial structures such as hotels, offices and malls will stop contracting next year. (addition by subtraction!) • Even small business optimism has improved slightly.Most of the reasons for the recent slowdown are still with us - less stimulus spending, the end of the inventory adjustment, problems in Europe and a slowdown in China, and cutbacks at the state and local level - but it appears Residential investment (RI) has bottomed and will most likely add to GDP growth in 2011. I believe the RI drag is now behind us, and RI is usually the best leading indicator for the economy. The data is still mixed and fits with my general view of a sluggish and choppy recovery (my view since the spring of 2009). Although I don't see a sharp increase in growth, I think the pace of recovery will probably pick up a little bit in 2011, and I'll take the over on the consensus view of 2.5% GDP growth in 2011. My guess is 3%+ GDP growth in 2011 - still not a strong recovery given the amount of slack in the economy, but an improvement over 2010. Unfortunately there probably will not be enough growth to significantly reduce the unemployment rate in 2011.

Treasury 30-Year Returns as Market Bellwether as Fed Policy Propels Trade

For the first time since the 1990s the U.S. 30-year Treasury bond is becoming the benchmark for the world’s biggest debt investors.

The Federal Reserve’s plan to buy $600 billion of U.S. government debt will focus about 86 percent of its purchases in notes due in 2.5 years to 10 years, leaving the so-called long bond as the security that most closely reflects market expectations for inflation. Since the Fed’s Nov. 3 announcement, the 30-year yield rose 0.28 percentage point, suggesting growing investor confidence in the central bank’s efforts to avoid deflation as the economy expands.

“The 30-year, with minimal Fed involvement, will become the bellwether issue for the bond market’s outlook on the economy and inflation,” said Gary Pollack, who helps oversee $12 billion as head of fixed-income trading at Deutsche Bank AG’s Private Wealth Management unit in New York.

Trading in Treasuries due in 11 years and more tripled since July, compared with a 60 percent jump for all maturities, according to Fed data. Volume reached $65.7 billion in the week ended Nov. 10 among the 18 primary dealers that trade with the central bank, the largest amount since at least 2001.

The rise in 30-year yields to a six-month high of 4.42 percent on Nov. 15 shows traders expect Fed Chairman Ben S. Bernanke will head off deflation, which can stall recoveries by curtailing spending and investment, said Rohit Garg, an interest-rate strategist in New York at BNP Paribas SA.

Tuesday, November 23, 2010

The trucks won't load themselves...11.23.2010

Monday, November 22, 2010

just a thought on TSA body searches

The trucks won't load themselves... 11.22.2010

Friday, November 19, 2010

Tuesday, November 16, 2010

The trucks won't load themselves...

“There is nothing with which every man is so afraid as getting to know how enormously much he is capable of doing and becoming.” --Soren Kierkegaard

Sunday, October 31, 2010

1970's stagflation, Liquidity-trap theorists, and economics gone unmoored from evidence:

Stagflation had a huge impact on economic thinking. Why? Mainly because it was predicted: the Friedman-Phelps natural rate hypothesis said that the apparent positive tradeoff between inflation and unemployment would prove only temporary, and that once inflation had gone on for a while, disinflation would involve a period of both high inflation and high unemployment.

So when that condition actually materialized, it gave huge prestige to the whole program of grounding macroeconomic models in microeconomic foundations. When I was in graduate school, which was just when the saltwater-freshwater divide was beginning to widen, I remember some of my classmates arguing that we should believe what the Chicago guys were saying — after all, they’d been right so far.

Of course, stagflation also gave a boost to the political right, although with much less justification; to this day, right-wingers basically wave the bloody shirt of stagflation to justify any and all opposition to government programs.

So what’s the parallel with the Nipponization of the U.S. economy? Well, like the stagflation of the 1970s, our current predicament was predicted well in advance. Liquidity-trap theorists — yes, with me playing a large and early role — told you what would happen if the economy suffered a sufficiently severe negative shock, one that pushed us up against the zero lower bound. We predicted, specifically, that:

1. Increases in the monetary base would fail to increase broad monetary aggregates, let alone boost the economy

2. Despite large monetary base expansion, the economy would slide toward deflation, not inflation

3. Despite large budget deficits, interest rates would stay low, because short-term rates would stay pinned at zeroAll of this was, like the natural rate hypothesis, grounded in a basic theoretical approach, embodied in simple models.

Everything that has happened these past two years has fit that basic model; meanwhile, those who failed to accept the implications of the liquidity trap have been wrong over and over again.

But here’s the thing: I see no signs of a rethink among most players. The slide toward deflation despite huge increases in the monetary base hasn’t shaken either the paleomonetarists who still predict hyperinflation or the it’s-all-the-Fed’s-fault crowd. The failure of interest rates to soar hasn’t shaken the deficit hawks. Instead, the usual suspects have taken the failure of an inadequate stimulus to produce a solid improvement in employment — a failure I, among others, predicted! — as proof that they were right.

Friday, October 29, 2010

The trucks won't load themselves... 4 days 2 hours and 59 mins till the polls open edition...

Milton Friedman On Japan - NYTimes.com http://post.ly/182zg

Freddie Mac: 90+ Day Delinquency Rate Declines Slightly in September http://goo.gl/fb/FwI7M