Highlights of the new law include:

“Passion and prejudice govern the world; only under the name of reason” --John Wesley

Friday, April 30, 2010

Anti-bullying Bill Passes Into Law

The Dangers of Deficit Reduction

Most economists also agree that it is a mistake to look at only one side of a balance sheet(whether for the public or private sector). One has to look not only at what a country or firm owes, but also at its assets. This should help answer those financial sector hawks who are raising alarms about government spending. After all, even deficit hawks acknowledge that we should be focusing not on today’s deficit, but on the long-term national debt. Spending, especially on investments in education, technology, and infrastructure, can actually lead to lower long-term deficits. Banks’ short-sightedness helped create the crisis; we cannot let government short-sightedness—prodded by the financial sector—prolong it.Faster growth and returns on public investment yield higher tax revenues, and a five to six percent return is more than enough to offset temporary increases in the national debt. A social cost-benefit analysis (taking to account impacts other than on the budget) makes such expenditures, even when debt-financed, even more attractive.

Finally, most economists agree that, apart from these considerations, the appropriate size of a deficit depends in part on the state of the economy. A weaker economy calls for a larger deficit, and the appropriate size of the deficit in the face of a recession depends on the precise circumstances.

--

DOI: 10.2202/1553-3832.1741

Available at: http://www.bepress.com/ev/vol7/iss1/art6

"Republicans and Democrats agree on financial reform -- but is that a good thing?"

The important takeaway from the Republican FinReg proposal is that they ... basically agree with the Democrats. At least on the big-picture stuff. They agree that the correct questions for financial reform are "how much information, and how much power, do regulators have?" In fact, their main differences with the Democrats are when they give politicians and regulators more discretionary power than Dodd does.

For instance, in the Dodd bill, the Treasury Department, FDIC and Federal Reserve all need to agree that a firm is failing in order for it to be taken over. In the Republican bill, the president and the D.C. district court also need to sign onto the decision. The question in both bills is whether there's any chance that the government will take down a firm before its imminent collapse sparks a crisis. It's too-big-to-fail meets too-hard-to-intervene.

Another example: In the Dodd bill, virtually all derivatives go through a clearinghouse so regulators can see what's happening and companies have to keep sufficient cash on hand to pay off their bets. In the Republican bill, the SEC, the Commodity Futures Trading Commission, and the Federal Reserve Board of Governors will write up regulations for which types of derivatives have to be cleared.

So if you basically liked the Dodd bill but were looking to give regulators just a little bit more discretion, then the Republicans are here for you (for a more comprehensive side-by-side comparison, head here). But what if you think that the financial sector itself is broken, and even good regulators can't fix a broken sector?

Here I'd direct you to Arnold Kling's 8-point FinReg fantasy. Kling is an adjunct scholar at Cato and a former economist at the Federal Reserve, but his plan -- which includes getting Fannie and Freddie out of the mortgage market, breaking up big banks, and making derivatives less attractive by deprioritizing them in bankruptcy hearings -- doesn't read like the Republican plan and it doesn't read like the Democratic plan.

The argument over the policy of financial reform -- which is distinct from its politics -- is not between Republicans and Democrats, or even liberals and conservatives. It's between people who think the financial sector needs to be changed and people who think we just need to give the regulators more information, power, and instructions so they can look after it better. Kling is a libertarian and I'm not, but we're probably closer on this than I am to either the Democratic or Republican proposal.

Thursday, April 29, 2010

Matt Roberts to run against Steve Davis in the 109

--

James A. Nichols IV

cell: (770) 312-6736

www.JimN2010.com

www.JimNichols4.com"Nothing in the world can take the place of Persistence. Talent will not; nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not; the world is full of educated derelicts. Persistence and determination alone are omnipotent. The slogan 'Press On' has solved and always will solve the problems of the human race." ---Calvin Coolidge (1872 - 1933) "Wovon man nicht sprechen kann, darüber muß man schweigen." --Lugwig Wittgenstein Logische-Philosophische Abhandlung 7

lunch time reads...

In particular, for the period June 1990 to March 1992, firms with fewer than 100 employees shed on net 160,000 jobs versus 110,000 from firms with more than 100 employees—a small-to-large firm destruction ratio of 1.46. For the period March 2001 to June 2003, small firms shed 79,000 jobs while larger firms destroyed 324,000 jobs—a small-to-large firm job destruction ratio of 0.24. Using the latest available data that cover the period September 2007 to June 2009, small firms lost 467,000 jobs compared with 543,000 for larger firms—a small-to-large firm job destruction ratio of 0.86.

Interestingly, the latest observation (for March–June 2009) shows that job destruction actually declined for smaller firms relative to larger firms whereas job creation rates improved for both small and large firms. This performance matters because the key factor for a sustained recovery will be a continued improvement in job creation rates at existing firms and stabilization in the rate of new business formation.

The DOL reports on weekly unemployment insurance claims:

In the week ending April 24, the advance figure for seasonally adjusted initial claims was 448,000, a decrease of 11,000 from the previous week's revised figure of 459,000. The 4-week moving average was 462,500, an increase of 1,500 from the previous week's revised average of 461,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 17 was 4,645,000, a decrease of 18,000 from the preceding week's revised level of 4,663,000.Click on graph for larger image in new window. This graph shows the 4-week moving average of weekly claims since 1971.The four-week average of weekly unemployment claims increased this week by 1,500 to 462,500.The dashed line on the graph is the current 4-week average. The current level of 448,000 (and 4-week average of 462,500) is still high, and suggests continuing weakness in the labor market. The 4-week average first declined to this level in December 2009, and has essentially moved sideways for four months.

And the post you must read today... In which I “attack old-fashioned economics,” i.e. utility maximization

Wednesday, April 28, 2010

"What going wrong in this country?"

Go read the study... A Modern Framework for Measuring Poverty and Basic Economic Security |

|

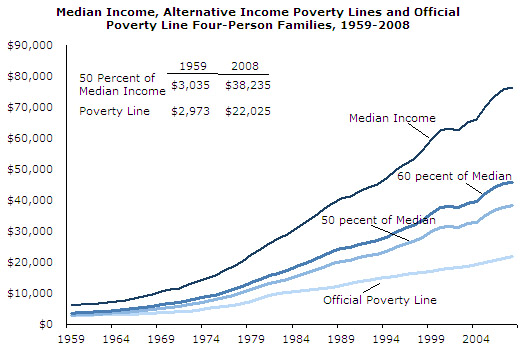

This report details how the dominant framework for understanding and measuring poverty in the United States has become a conservative one. The current U.S. approach to measuring poverty views poverty only in terms of having an extremely low level of annual income, and utilizes poverty thresholds that are adjusted only for inflation rather than for changes in overall living standards. As a result, the official poverty measure has effectively defined deprivation down over the last four decades, moving it further and further away from mainstream living standards over time, as well as from majority public opinion of the minimum amount needed to “get along” at a basic level. A new Supplemental Income Poverty Measure (SIPM) proposed by the Obama administration makes some important improvements to the current poverty measure. However, the SIPM remains a conservative approach that appears likely to lock in the poverty line at an extremely low level. This report proposes a new framework for measuring poverty and basic economic security in the United States. Instead of being limited to the “extremely-low-income-only” approach the current poverty line and administration’s proposed Supplemental Income Poverty Measure (SIPM) represent, this framework should utilize measures of low income and other forms of economic hardship related to low income.

Tuesday, April 27, 2010

bedtime reads...

Stocks Plunge, Asia Bond Risk Climbs on Greece, Portugal Debt

“People are panicking about the contagion effect,” said Sydney-based Simon Bonouvrie, who helps manage $1.7 billion at Platypus Asset Management. “It’s an overreaction but the risk aversion will remain until these problems are resolved.”

Credit-default swaps on European sovereign debt surged to records. Contracts tied to Greek government bonds climbed 111 basis points to 821, according to CMA DataVision. Portugal rose 54 basis points to 365. Yields on 10-year Treasuries tumbled 12 basis points to 3.68 percent. Greek two-year note yields soared to almost 19 percent and Portugal’s jumped to 5.7 percent.

Why again are Republicans defending Wall Street and blocking reform?

Levin wanted to know whether Sparks thought Goldman had a responsibility to tell its client that it was "getting comfortable" by selling the security short, by betting against it. In other words, did Goldman have a responsibility to tell its client that Goldman's own opinion was that the security was likely a bad investment?

And Daniel Sparks simply would not answer the question. ... But a relentless Levin kept pressing the point, which boiled down to something very simple: Did Goldman have a responsibility to its client to indicate its own evaluation of the securities it was pushing?

Susan Collins, the ranking Republican present on the committee, followed up with an even more direct question: "Do you have a responsibility to act in the best interest of your client?" Seems like a simple enough question, but Sparks could not answer it either, saying only, after much pressure: "I believe we have a duty to serve our clients."

Right then and there, Goldman Sachs lost any chance it had of making a positive case to the American public. Right then and there, Goldman Sachs declared to all who were watching that its vaunted dedication to the interests of its clients was just so much hot air.

Goldman's defenders, if you can find them, will say that Goldman's responsibility was just to broker deals, to be a "market maker." If a sophisticated investor wanted to get on the side of a deal that Goldman was betting against, that's OK. ...

Douglas to run for PSC, Lunsford considers Senate

Despite qualifying yesterday for a fourth term in the State Senate, John Douglas has decided to change gears and run for the Public Service Commission (District 2).

Bobby Baker, who currently holds the seat, has decided to retire, during the week of qualifying no less, leaving the GOP looking for a candidate.

State Rep. John Lunsford (R-McDonough) has confirmed that he is looking at the seat Douglas will leave open. I've put a call into Douglas, but the Senate was in session at the time so he could not be reached for comment.

Obama's Home Tax Credit a bust...

From David Kocieniewski at the NY Times: Home Tax Credit Called Successful, but CostlyThough the Treasury Department and the real estate industry have termed the program a success, helping 1.8 million people buy homes, many tax policy experts say it has been singularly cost-ineffective: most of the $12.6 billion in credits through end of February was collected by people who would have bought homes anyway or who in some cases were not even eligible.There is no question this program was very costly. And why is the Treasury confusing activity with accomplishment? Sure sales briefly surged, but were new households formed? How many new jobs were created?“We were happy in our apartment, but $8,000 was just too much to pass up,” said [Mr. James Green, a student at Purdue University], 29, who shopped furiously with his wife for two months before signing a contract in March to buy a three-bedroom ranch. “We bid on a couple places that didn’t work out,” he said, “but we always made sure we had a backup plan because we didn’t want to miss the deadline for the credit. And when we finally agreed to a contract, it was this huge relief.” For every home buyer like the Greens, real estate agents say there are at least three others who collected the credit even though they would have bought without it. That means for each new buyer who was truly lured into the market by the credit, the federal government paid more than $30,000.This is very optimistic - the ratio was probably 5-to-1 for the initial credit and even higher for the extension. But this shows two failures of the tax credit: 1) the high cost, and 2) it was just moving people from apartments to homes and didn't reduce the excess housing inventory (yes, rentals count as housing inventory too).“The tax credit helped to stanch the price declines, which had substantial benefit for the entire economy,” said Mark Zandi at Moody’s Economy.com.And this has been the policy - support asset prices by limiting the supply (all the foreclosure delays), and pushing demand (low mortgage rates and the tax credit). This has helped the banks significantly, and Zandi argues this has boosted confidence. Maybe ... but I'm not convinced that supporting house prices above the market clearing level to help the banks and boost consumer confidence makes sense. I think targeting jobs - and therefore household formation - would have been a far more cost effective program.

Portugal Suffering Greek Contagion Puts Pressure on EU Markets -

Greek bonds tumbled yesterday, pushing yields to the highest since at least 1998, on speculation over the timing of the European Union bailout package for Greece. Portuguese spreads, the extra yield that investors demand to hold its debt rather than German equivalents, jumped to 218 basis points, the most since at least 1997.

Portuguese Prime Minister Jose Socrates’ push to convince investors his country will avoid Greece’s fate is being hobbled by an economy that’s expanded less than an annual average of 1 percent for a decade and is reliant on tourism and industries such as cork and pulp.

While Portugal’s public debt of 77 percent of gross domestic product is on a par with that of France, the burden including corporate and household debt exceeds that of Greece and Italy, at 236 percent of GDP. The savings rate is the fourth-lowest among 27 members of the Organization of Economic Cooperation and Development, according to the Paris-based group’s data.

No Growing

“The reason we’re concerned about Portugal is not because its public sector debt ratios are excessively high, it’s more that the Portuguese economy doesn’t really grow,” said Kenneth Wattret, chief euro region economist at BNP Paribas SA in London.

EU policy makers’ difficulty in containing the Greek crisis is stoking the threat of contagion, just as the near-collapse of Bear Stearns Cos. in 2008 undermined other U.S. banks, exacerbating the credit crisis.

The risk for Portugal is that investors who are trying to protect their portfolios from a Greek-like rout will dump holdings of small euro countries, such as Portugal. Once that happens, surging bond yields could put Portugal in the same spiral that Greece is trying to escape.

‘Conspicuously Vulnerable’

Portugal is among countries that are “conspicuously vulnerable” and may need a bailout, said Kenneth Rogoff, a professor at Harvard University in Cambridge, Massachusetts, in a telephone interview.

Monday, April 26, 2010

German Government More Upbeat on Jobs Market - -

The German government is about to present an upbeat outlook for the economy, predicting GDP growth of 1.4 percent and unemployment of 3.4 million in 2010, virtually unchanged from 2009, according to the draft of its latest forecast seen by SPIEGEL. Four months ago it had predicted the jobless total would reach 3.7 million this year.

The German government expects the economy to grow by 1.4 percent in 2010 and 1.6 percent in 2011, according to the latest forecast, SPIEGEL has learned.

The government is particularly upbeat on unemployment, predicting that the jobless total will rise by just 10,000 this year, according to the draft of the government's spring economic forecast due to be presented on Wednesday by Economy Minister Rainer Brüderle.

Average unemployment for 2010 is expected to remain at 3.4 million, or 8.2 percent, unchanged from 2009. That is a significant improvement from the government's prediction at the start of 2010 that unemployment would rise to 3.7 million this year. The government expects unemployment to remain at 3.4 million in 2011.

The government's forecast for tax revenues is higher than four months ago as a result of the expected economic growth and stable jobs market.

The government's 2010 GDP forecast is slightly less optimistic than that of Germany's leading economic research institutes which expect 1.5 percent growth this year. But its 2011 outlook of 1.6 percent is more upbeat than the institutes' prediction of 1.4 percent.

'We're on a Slippery Slope': Will the Greek Bailout Destroy the Euro Zone?

Large segments of the professional world agree with the euroskeptics' criticism. Hardly any economists are convinced that the planned injection of billions from European and German coffers can fix Greece's malaise. Even worse, many critics doubt that the rescue funds pledged to date are sufficient.

The Greeks will need to borrow about €130 billion by the end of 2012, when the loans under the current EU package mature. However, politicians had assumed until now that the country's financial requirements would not exceed €80 billion. But that amount would only be enough until the end of 2011, which would mean that Greece would have to raise the rest of the money in the financial markets.

That will be difficult. Leading economists don't believe that the risk premium on Greek treasury bonds will decline simply because the EU is now pumping money in Athens' direction. As a result, interest rates on Greek bonds will remain high -- meaning the Greek state will have to shoulder a large financial burden.

The European Union must therefore encourage the country onto a path of consolidation and reform, says renowned economist Martin Hüfner, so that it can repay its debts in a few years. "If this doesn't happen, the returns on the outstanding bonds will only grow," he says.

Little Confidence

Michael Heise, chief economist for the multinational insurance giant Allianz, agrees. "The EU's money will only help the Greeks in the short term" he says. "The key question is how the country will manage to get out (of debt)."

Not even Schäuble's own experts have full confidence in the European bailout package. They say that the high risk premiums in the markets demonstrate that investors have very little confidence in the European measures.

Two risk scenarios are currently making the rounds among economists. In the first scenario, Greece goes bankrupt and its loans are suspended, extended or restructured. In the second scenario, the country is forced to withdraw from the euro zone, enact a currency reform and hazard an economic new beginning. In both cases, large portions of the European bailout money would be lost.

Parallels are already being drawn to another historical showdown between governments and speculators in the early 1990s. At the time, hedge fund entrepreneur George Soros forced the Bank of England to its knees, and the British pound had to withdraw from the European currency system in place at the time.

‘Urgent Action’ Needed to Control Capital Flows, StanChart Says -

Emerging markets need to take “urgent action” on the surge of liquidity and capital flowing into their economies because they could spur inflation and trigger another crisis, according to Standard Chartered Plc.The capital flows range from bank lending and portfolio investments to “hot money” and corporate bond issuance, economists Gerard Lyons and Natalia Lechmanova wrote in a report published today. Greater currency flexibility, tighter monetary policy and some capital controls are among measures that can be taken to help manage the inflows, they said.

“Just as excess liquidity contributed to problems in the Western developed economies ahead of the financial crisis, excess liquidity has the potential to trigger fresh economic and financial problems across the emerging world,” they wrote. “Many countries do not have the capacity to absorb such inflows and thus the money often ends up in equity or real estate, adding to inflationary pressures.”

The World Bank predicts as much as $800 billion in global capital flows this year, compared with about an annualized $450 billion to developing economies in the second half of 2009, it said in a report this month. In Asia, which is leading the recovery from the global recession, some central banks are already raising interest rates or taking steps to remove excess cash in their banking systems to fend off inflation risks.

Merkel Tells Greece, Euro Region That Bailout Isn’t a Done Deal

Polls in recent weeks show Merkel’s Christian Democrats and their Free Democratic allies at risk of losing their governing majority in North Rhine-Westphalia, Germany’s most populous state. The two parties, which also underpin Merkel’s national government, fell short of a majority with support of 46 percent in an April 21 Forsa poll for Stern magazine. The margin of error was plus or minus 3 percentage points.

A defeat for Merkel might wipe out her coalition’s majority in the upper house of the national parliament and hamper her government’s efforts to cut taxes and extend the life of German nuclear power plants.

Merkel told the rally she wants Greece to agree to several years of budget cuts before releasing any German aid. “Greece has put savings measures into effect this year, but one year won’t be enough” to restore confidence in the financial markets, she said.

Obama's massive tax burden.... and how working families get a free ride on the backs of the rich...

That’s the portion of American households that owe no income tax for 2009. The number is up from 38 percent in 2007, and it has become a popular talking point on cable television and talk radio. With Tax Day coming on Thursday, 47 percent has become shorthand for the notion that the wealthy face a much higher tax burden than they once did while growing numbers of Americans are effectively on the dole.Neither one of those ideas is true. They rely on a cleverly selective reading of the facts. So does the 47 percent number.Given that taxes are likely to be one of the big political issues of the next few years — and maybe the biggest one — it’s worth understanding who really pays what in taxes. Once you do, you can get a sense for our country’s fiscal options. How, in other words, will we be able to close the huge looming gap between the taxes we are scheduled to pay and the services we are scheduled to receive?

The answer is that tax rates almost certainly have to rise more on the affluent than on other groups. Over the last 30 years, rates have fallen more for the wealthy, and especially the very wealthy, than for any other group. At the same time, their incomes have soared, and the incomes of most workers have grown only moderately faster than inflation.

So a much greater share of income is now concentrated at the top of distribution, while each dollar there is taxed less than it once was. It’s true that raising taxes on the rich alone can’t come close to solving the long-term budget problem. The deficit is simply too big. But if taxes are not increased for the wealthy, the country will be left with two options.

It will have to raise taxes even more than it otherwise would on everybody else. Or it will have to find deep cuts in Medicare, Social Security, military spending and the other large (generally popular) federal programs.

All the attention being showered on “47 percent” is ultimately a distraction from that reality.

The 47 percent number is not wrong. The stimulus programs of the last two years — the first one signed by President George W. Bush, the second and larger one by President Obama — have increased the number of households that receive enough of a tax credit to wipe out their federal income tax liability.

But the modifiers here — federal and income — are important. Income taxes aren’t the only kind of federal taxes that people pay. There are also payroll taxes and investment taxes, among others. And, of course, people pay state and local taxes, too.

Even if the discussion is restricted to federal taxes (for which the statistics are better), a vast majority of households end up paying federal taxes. Congressional Budget Office data suggests that, at most, about 10 percent of all households pay no net federal taxes. The number 10 is obviously a lot smaller than 47.

The reason is that poor families generally pay more in payroll taxes than they receive through benefits like the Earned Income Tax Credit. It’s not just poor families for whom the payroll tax is a big deal, either. About three-quarters of all American households pay more in payroll taxes, which go toward Medicare and Social Security, than in income taxes.

Focusing on the statistical middle class — the middle 20 percent of households, as ranked by income — underlines this point. Households in this group made $35,400 to $52,100 in 2006, the last year for which the Congressional Budget Office has released data. That would describe a household with one full-time worker earning about $17 to $25 an hour. Such hourly pay is typical for firefighters, preschool teachers, computer support specialists, farmers, members of the clergy, mail carriers, secretaries and truck drivers, according to the Bureau of Labor Statistics.

Taking into account both taxes and tax credits, the average household in this group paid a total income tax rate of just 3 percent. A good number of people, in fact, paid no net income taxes. They are among the alleged free riders.

But the picture starts to change when you look not just at income taxes but at all taxes. This average household would have paid 0.8 percent of its income in corporate taxes (through the stocks it owned), 0.9 percent in gas and other federal excise taxes, and 9.5 percent in payroll taxes. Add these up, and the family’s total federal tax rate was 14.2 percent.

I realize that it’s possible to argue that payroll taxes should be excluded from the discussion because they pay for benefits — Social Security and Medicare — that people receive on the back end. But that argument doesn’t seem very persuasive.

Why? People do not receive benefits equal to the payroll taxes they paid. Those who die at age 70 will receive much less in Social Security and Medicare than they paid in taxes. Those who die at 95 will probably get much more.

The different kinds of federal taxes are really just accounting categories. At the end of the day, the government has to cover the cost of all its operations with revenue from all its taxes. We can’t wish our deficit away by saying that it’s mostly a Medicare and Social Security deficit.

If anything, the government numbers I’m using here exaggerate how much of the tax burden falls on the wealthy. These numbers fail to account for the income that is hidden from tax collectors — a practice, research shows, that is more common among affluent families. “Because higher-income people are understating their income,” Joel Slemrod, a tax scholar at the University of Michigan, says, “We’ve been overstating their average tax rates.”

State and local taxes, meanwhile, may actually be regressive. That is, middle-class and poor families may face higher tax rates than the wealthy. As Kim Rueben of the Tax Policy Center notes, state and local income taxes and property taxes are less progressive than federal taxes, while sales taxes end up being regressive. The typical family pays a lot of state and local taxes, too — almost half as much as in federal taxes.

There is no question that the wealthy pay a higher overall tax rate than any other group. That is an American tradition. But there is also no question that their tax rates have fallen more than any other group’s over the last three decades. The only reason they are paying more taxes than in the past is that their pretax incomes have risen so rapidly — which hardly seems a great rationale for a further tax cut.

So why are those radio and television talk show hosts spending so much time arguing that today’s wealthy are unfairly burdened? Well, it’s hard not to notice that the talk show hosts themselves tend to be among the very wealthy.

No doubt, like the rest of us, they don’t particularly enjoy paying taxes. They are happy with the tax cuts they have received lately. They would prefer if other people had to pick up the bill for Medicare, Social Security and the military — people like, say, firefighters, preschool teachers, computer support specialists, farmers, members of the clergy, mail carriers, secretaries and truck drivers.

I'll be at the Gold Dome this morning... say hello if you are up there...

Questions about Aggregate Demand

Both Pete Boettke and Scott Sumner have mulling over the idea of changes to aggregate demand. As a result, both have asked good questions on this issue. First, Pete poses the following question:What precisely is aggregate demand failure and how would you know if you saw it?There were a large number of responses to his question in the comment section of his blog and of those I like best what Bill Woolsey had to say:Deficient aggregate demand--aggregate demand less than productive capacity = excess demand for money--a quantity of money less than the demand to hold money = a market interest rate greater than the natural interest rate--saving greater than investment.How do you know that aggregate demand is deficient? If cash expenditures have fallen below their trend growth path, and the levels of prices and wages have not fallen in proportion, then the presumption should be that aggregate demand is too low, that there is an excess demand for money, and that the market interest rate is above the natural interest rate.

Never, never, never look at market interest rates and the quantity of money and compare them with historically "normal" levels.

So does the data show any of the characteristics Bill outlines above? The answer is yes, as can be seen here and here. Next, Scott Sumner is wondering whether there is a better way to describe changes in aggregate demand:

I’ve constantly complained that there is no word in the English language for nominal shocks, i.e. unexpected increases and decreases in NGDP... So we need terms for changes in M*V, which is the sort of nominal variable the Fed should be trying to stabilize.Here is my reply to Sumner in his comment section:cash spending. That is so intuitive and should be understood by most folks.Awhile back we talked about reframing the nominal income targeting approach by saying the Fed should stabilize total

Consequently, in terms of what is a nominal spending shock we can simply say “There has been a sudden collapse in total cash spending” for a negative AD. Alternatively, we can say “Total cash spending is increasing at an unsustainable pace” for a positive AD shock.

Of course there is always Leland Yeager's take on this issue.

More Debt Fearmongering at the Washington Post

This piece includes the information that the national debt "totaled $8,370,635,856,604.98 as of a few days ago." Boys and girls are you impressed by that big number? Are you scared yet? This is Fox on 15th here -- they'll keep trying.

This sentence continues by telling readers that this number is not "even counting the trillions owed by the government to Social Security and other pilfered trust funds." How did the author determine that the trust funds were "pilfered." The government didn't do what he wanted it to with the money? Wow, that gives a reporter the right to say the money was "pilfered." Apparently it does at the Post.

The article does not include the views of any experts who do not view the debt as a serious problem. It presents an inaccurate assertion (in the context presented) from Brookings economist Bill Gale that the debt: "This [running up the debt] is all an exercise in current generations shifting burdens on future generations."Actually, the debt being run up at present is helping future generations by keeping their parents employed, improving the infrastructure and providing them with a better education. There is little or no real burden associated with this debt since much of the debt being issued is held by the Fed. The interest on these bonds is therefore paid to the Fed, which in turn refunds the money to the government.

Last week, the NYT reported that the Fed paid more than $47 billion in interest to the government. So, where is the burden on our children? If we do get the economy back to normal levels of output the deficit will be at a manageable level. Over the long-term, if we don't fix the health care system, we will face serious budget problems, but this is an argument about the need to fix our health care system, not about the deficit.

Supreme Court

With President Obama about to fill a vacancy on the U.S. Supreme Court, Robert Reich has chosen to re-run an article he wrote prior to the confirmation of (now Chief Justice) John Roberts to the Court in 2005. The article is about the values of nominees -- not the hot-button issues of abortion, gun laws, gay marriage, etc., but rather the interesting distinction of whether a particular nominee is likely to favor "property" or "community" in making his/her decisions.

We'll hear much blather about "upholding the Constitution," "original intent," "following the law," "judicial activism," and numerous other hypocrisies from the Republicans -- especially after the conservatives on this Court have overturned one precedent after another to impose conservative ideology. After that majority's astounding 5-4 decision in Citizens United -- to allow corporations to pour unlimited amounts of money into our elections and referendums -- no one can afford to be complacent about who is appointed."Obama’s Supreme Court Nomination, the Economy, and What I Advised the Senate in 2005." By Robert Reich, April 24, 2010

http://robertreich.org/post/546025291/obamas-supreme-court-nomination-the-economy-and-what

Saturday, April 24, 2010

South Park Controversy and Fallacies of Muslim Extremists

Yunus Muhammad” says in the interview that the Qur’an instructs Muslims to ‘terrorize the disbelievers.’ It does no such thing. The Qur’an instructs Muslims to live at peace with non-Muslims who are at peace with them. (It turns at that this minor, fringe group is led by converts from Judaism, one of them a former settler in Israel. It is not clear whether they have sincerely exchanged one fanaticism for another or whether this is a false flag operation, perhaps of an intelligence agency. In any case, it is no accident that they are ignorant of the Qur’an. (For a mainstream Muslim response, see The American Muslim.)

The verse to which this individual referred was in the chapter of the Spoils (al-Anfal), 8:60:

Wa a`iddu lahum ma istata`tum min quwwatin wamin ribati ‘lkhayli turhibuna bihi `aduwwa Allahi wa`aduwwakum

Which means, “Prepare against them all the power, and all the war horses that you can, whereby to strike fear into the enemies of God and your enemies.”

The context of this verse is the Battle of Badr on March 17, 624 of the Common Era. In the 610s, the pagan Meccans had persecuted the new religion of Islam and ultimately chased Muhammad and the Muslims out of Mecca for preaching the one God. They took refuge in the nearby city of Yathrib, which became known as Medina (i.e. the City [of the Prophet]). The wealthy Meccan polytheists hoped to wipe Islam and the Muslims out, and fought skirmishes with them. The early Muslims riposted by raiding Meccan trading caravans, in hopes of weakening their foe economically. That March in 624, the Meccans sent out their best fighters to protect a caravan. A Muslim force more or less stumbled onto this expedition. Badr, named after a well south of Medina, was the first major battle between the two sides, and the Muslims won it, thus saving themselves from genocide.

So what the Qur’an is saying in 8:60 is that the Muslims should keep a stable of fighting steeds at the ready and let the Meccans know about it, to strike fear into the hearts of an enemy trying to wipe out them and their religion.

The verse does not command any act of ‘terrorism.’ It commands that Muslims attempt to forestall irrational violence against a Muslim state through deterrence. It is defensive in intent.

The verse does not say anything about mere ‘disbelievers’ or non-Muslims. It is warning of the designs of ‘enemies of God,’ i.e. militant and violent anti-Muslims. Moreover, there is no implication that Muslims should act as individuals or vigilantes. Medina was a city-state that the Prophet Muhammad ruled, and he gave the orders. Muslims could not just run off and attack whomever they pleased whenever they pleased. A duly constituted Muslim state was in charge of defense of the community.

So unless Yunus Muhammad can find a group of armed individuals who aim at violently attacking Muslims en masse and trying to wipe out them and their religion, he should stuff a sock in it and go home.

In fact, trying to import terrorism into the Qur’an is an infinitely greater blasphemy than that of any Western cartoonist, and one would hope Muslim groups would get more upset about Yunus Muhammad and ‘Revolution Muslim’ than about an irreverent American tv program.

Unfortunately, along with people with genuinely hurt feelings, there will be some cynical political forces that manipulate Muslim fundamentalists and will try to advance their agendas by taking advantage of this South Park controversy (the show depicted the Prophet Muhammad in a bear suit to avoid showing him– which is about as close as South Park gets to deference to religious feelings).

Bush Insider Reveals Guantanamo Deception: Hundreds of Innocents Jailed

Colonel Lawrence B. Wilkerson, Chief of Staff to U.S. Secretary of State Colin Powell, provided shocking new testimony from inside the Bush Administration that hundreds of the men jailed at Guantanamo were innocent, the top people in the Bush Administration knew full well they were innocent, and that information was kept from the public.

Wilkerson said President Bush, Vice President Cheney and Secretary of Defense Rumsfeld “indefinitely detained the innocent for political reasons” and many in the administration knew it. The wrongfully held prisoners were not released because of political maneuverings aimed in part to cover up the mistakes of the administration.

Colonel Wilkerson, who served in the U.S. Army for over thirty years, signed a sworn declaration for an Oregon federal court case stating that he found out in August 2002 that the US knew that many of the prisoners at Guantanamo were not enemy combatants. Wilkerson also discussed this in a revealing and critical article on Guantanamo for the Washington Note.

How did Colonel Wilkerson first learn about the innocents in Guantanamo? In August 2002, Wilkerson, who had been working closely with Colin Powell for years, was appointed Chief of Staff to the Secretary of State. In that position, Wilkerson started attending daily classified briefings involving 50 or more senior State Department officials where Guantanamo was often discussed.

It soon became clear to him and other State Department personnel “that many of the prisoners detained at Guantanamo had been taken into custody without regard to whether they were truly enemy combatants, or in fact whether many of them were enemies at all.”

How was it possible that hundreds of Guantanamo prisoners were innocent? Wilkerson said it all started at the beginning, mostly because U.S. forces did not capture most of the people who were sent to Guantanamo. The people who ended up in Guantanamo, said Wilkerson, were mostly turned over to the US by Afghan warlords and others who received bounties of up to $5000 per head for each person they turned in. The majority of the 742 detainees “had never seen a U.S. soldier in the process of their initial detention.”

Rewarding Teacher Performance? Resist the Temptation to “Race to Nowhere”

Friday, April 23, 2010

@JimN2010 The 2010 election...

Benefit for Uninsured May Still Pose Hurdle

“Given the choice, a lot of people are going to purchase coverage rather than pay the penalty — they simply want the security of having health insurance,” said Jennifer Tolbert, principal policy analyst at the Kaiser Commission on Medicaid and the Uninsured, an initiative of the Kaiser Family Foundation (not associated with Kaiser Permanente, the health insurance company). She said that had been the experience in Massachusetts under a similar initiative. But she added, “The key is to make coverage affordable.”

According to the Congressional Budget Office, some 32 million more Americans will have insurance by 2019 under the new law, about half of whom will be buying health insurance on the individual market for the first time (the other half will be covered for the first time under Medicaid, which is being expanded to include more of the poor).

But Edmund F. Haislmaier, senior research fellow of health policy studies at the Heritage Foundation, a conservative research group, said he was skeptical that so many uninsured people would actually start buying insurance. “We’re premising all this on the idea that we’ll cross-subsidize older, sicker people with a lot of young healthy people, whom we assume will buy the coverage,” he said. “But what if they don’t?”

Many of the uninsured in America are in the same economic boat as Mr. Mann. Some 60 percent of the uninsured earn less than 200 percent of the federal poverty level ($21,660 for a single person and $44,100 for a family of four), according to Sara R. Collins, of the Commonwealth Fund, a health care research group. As earnings increase, people are more likely to be insured, experts say.

A recent study by the fund said that about one-third of people who tried to buy health insurance on their own were turned down or charged more because of a medical condition. But three-quarters walked away for other reasons, and most cited price; 60 percent said it was either “difficult” or “impossible” to find an affordable plan, said Ms. Collins, vice president for the fund’s Affordable Health Insurance Program.

Jacqui Brownstein, 63, a freelance copy editor and proofreader, said she moved to Lancaster, Pa., from New Jersey in 2004 primarily because health insurance was more affordable there. But she can’t afford it anymore; the last time she bought insurance, she paid $4,300 a year, but the rate quoted last year was $5,700. “There was no way I could afford it, so I dropped it,” said Ms. Brownstein, a smoker who has Type 2 diabetes and a family history of ovarian cancer.

Premium subsidies, which will be available to people who buy insurance through the exchanges being established, are supposed to address that problem, experts say. A 40-year-old in a medium-cost geographic area who earns $21,660 (200 percent of the federal poverty level) and whose annual premium is $3,500, for example, would receive a subsidy of $2,135 that goes directly to the insurer, while he or she pays $1,365. A family of four with an income of $44,100 would pay $2,778 while the government subsidizes the plan to the tune of $6,656.

The proportion of income people at this level have to pay for insurance is capped at no more than 6.3 percent of their earnings.

As income increases, the subsidy drops; families earning 300 to 400 percent of the federal poverty level are expected to pay up to 9.5 percent of their income, an amount that ranges from $6,284 to $8,379 per year; the federal subsidy is from $3,150 to $1,056. At the same time, however, a provision states that anyone who cannot find a premium that costs less than 8 percent of their income is exempted from the penalty.

It’s hard to predict whether the carrots and sticks of subsidies and penalties will suffice to bring people into the system, when there are so many are unemployed or underemployed people, many earning less in today’s economy than before and worried about job security and prospects.

From a pure dollars-and-cents point of view, it is cheaper for people just to pay the penalty. Even when fully implemented in 2016, the penalty is limited to no more than 2.5 percent of taxable income, and it starts out even lower, with a penalty of $95 or 1 percent of income in 2014.

“It’s hard to analyze because people are making health decisions based on their wallets,” said Sara Horowitz, who founded the Freelancers Union, a nonprofit organization that offers health insurance to freelancers.

Thursday, April 22, 2010

We should've passed a bigger stimulus package...

Back in February, some observers were characterizing the Administration's forecast as too rosy. Now, the Administration forecast is looking positively pessimistic by comparison to private sector forecasters, at least over 2010.

First, consider the February 2010 forecasts from the Administration (teal squares) against the April 2010 mean forecast from the Wall Street Journal survey (red line).

Figure 1: Real GDP (09Q4 3rd release) (blue), and WSJ mean forecast (red), and trimmed hi/low (gray), and Administration (teal squares) and CBO forecasts (scarlet triangles) (February 2010). Source: BEA, WSJ April survey, CEA and CBO.Not only have expectations regarding the path (in levels) of GDP risen, the Administration's forecast is now at the low end of the range of forecasts (I've trimmed the top 10% and bottom 10% of forecasts off).

Of course, just because conditions are exceeding expectations back in February (actually, December, since the Administration forecasts were locked down way in advance of the budget's release) doesn't mean all is well. One wants to know how much slack there is in the economy. This is shown in Figure 2:

Figure 2: Log output gap; and forecast output gap using WSJ April mean forecast, and trimmed high. Source: BEA, CBO, WSJ April survey.What this demonstrates is that, taking the CBO's estimate as given, even now the output gap is on the order of 6 ppts of GDP (in log terms), and will be only slightly under 5 ppts by year-end (4 ppts, using the trimmed high forecast).

We should've passed a bigger stimulus package...

GM Repays Treasury Loan in Full, TARP Repayments Reach $186 Billion

The U.S. Department of the Treasury today announced that General Motors (GM) has fully repaid its debt under the Troubled Asset Relief Program (TARP). GM paid the remaining $4.7 billion of the total $6.7 billion in debt owed to Treasury. The repayment comes five years ahead of the loan maturity date and ahead of the accelerated repayment schedule the company announced last year.Total TARP repayments now stand at $186 billion – well ahead of last fall's repayment projections for 2010. With this repayment, less than $200 billion in TARP disbursements remain outstanding.

"We are encouraged that GM has repaid its debt well ahead of schedule and confident that the company is on a strong path to viability," said Treasury Secretary Tim Geithner. "This continued progress is a positive sign for our auto investment – not only more funds recovered for the taxpayer but also countless jobs saved and the successful stabilization of a vital industry for our country."

After this repayment, the remaining Treasury stake in GM consists of $2.1 billion in preferred stock and 60.8 percent of the common equity.

Why It's Hard To Take Tax Complainers Seriously

Is NOT Providing An Earmark An Ethics Violation?

If you read the headline above quickly you may not get the extraordinary irony of this story from yesterday's Roll Call: Someone who did not get the earmark he requested says that's a violation of the House ethics rules.

It's usually the other way around; it's sometimes considered an ethics issue when a representative or senator requests and gets an earmark for someone, especially if they have contributed to his or her campaign, provided other support, or has some other connection. In this case, however, House Defense Appropriations Subcommittee Chairman Norm Dicks (D-WA) refused the request and the person who was turned down didn't like it.

Wednesday, April 21, 2010

Economic costs vs. Budget costs

There is, of course, an odd asymmetry, in the treatment of costs. The additional economic costs for the Iraq category do seem like costs to me (transfers to Rest-of-World via higher oil costs, cost-of-life calculations due to American casualties), while the "costs" that Mr. Lawler attributes to PPACA do have some offseting benefits: if one reads the RAND report, for instance, length of life is extended for some of the formerly uninsured, which adds to the "costs".

Tuesday, April 20, 2010

Financial Reform

Normally, nothing is likely to put voters to sleep faster than talking about financial reform. "Nothing to do with me...zzzzz." (Wrong, of course, as the Great Recession proved.)But the Republican leadership is expert at finding a way to lie about (and thereby seek political advantage in) even so seemingly abstract an issue, by calling anything to do with such reform a "Big Business Bailout" -- a lie, but that's never been an obstruction to Republicans seeking power:"Sen. Corker Refutes Right-Wing Talking Point: The Resolution Fund Is ‘Anything But A Bailout.’" 4/19/2010

http://thinkprogress.org/2010/04/19/corker-mcconnell-bailout/"Mitch McConnell Gets it Wrong." By Robert Reich, 4/19/2010

http://www.huffingtonpost.com/robert-reich/mitch-mcconnell-gets-it-w_b_543474.html"Dems Dig For GOP Votes Ahead Of Key Financial Reform Vote." April 19, 2010

http://tpmdc.talkingpointsmemo.com/2010/04/dems-dig-for-gop-votes-ahead-of-key-financial-reform-vote.php"Democrats stand by $50B fund." 4/19/2010

http://www.politico.com/news/stories/0410/36060.htmlAnd here's a bit about the suit against Goldman Sachs:"Would Financial Reform Have Stopped Goldman's Scheme?" 4/19/2010

http://www.prospect.org/csnc/blogs/tapped_archive?month=04&year=2010&base_name=would_financial_reform_have_stRepublicans on the S.E.C. voted against filing suit against Goldman Sachs:

"Party lines." By Mark Kleiman, April 19th, 2010

http://www.samefacts.com/2010/04/financial-crises/party-lines/

P.S. In case you missed it in the "Sen. Corker..." article above, here's the link to the memo from Frank Luntz, the Republicans' adviser on the manipulation of voters through language: http://timeswampland.files.wordpress.com/2010/04/languageoffinancialreform.pdf. The name of Luntz's outfit, The Word Doctors, is instructive in a literal sense (he does advise the use of particular words and phrases), but the motto makes the real point: "It's not what you say, it's what people hear." What's interesting is that, although anyone who pays attention to political news knows about the Luntz memos and hears the Republicans constantly using these manipulative words, the words still are just as effective with the general public, who are unaware that they're being manipulated (for reasons I've discussed before -- and will again).

Former government employee Dana Perino doesn’t trust the government.

A recent Pew poll found that nearly 80 percent of Americans don’t trust the federal government and have little faith that it can solve the country’s problems, thus marking public confidence in the government at one of the lowest points in half a century.Last night on Fox News, host Greta Van Susteren asked former Bush administration White House Press Secretary Dana Perino about the poll. Perino, herself a former federal government employee, wondered what the other 20 percent of Americans polled in the Pew survey know that “the rest of us” do not:PERINO: Well, I think it’s interesting that the 80 percent of the American people said they didn’t trust the government, and it sort of made me think, what do the other 20 percent know that the rest of us don’t know? Not a good number.Perino later speculated that the massive discontent could be because of the rising deficits, which she said “this year alone higher than the last four years of the Bush administration combined.” She neglected to mention that her former boss is responsible for most of it.

Even Mark Halperin Won't Defend the Republicans Anymore

I confess I did not think this day would ever come. I thought nothing would ever be too much for Mark Halperin:

Steve Beneen:White House economic adviser Austan Goolsbee... explained why GOP talking points about "bailouts" aren't just wrong, but are in fact the opposite of reality. Goolsbee also did a nice job highlighting the GOP's motivations for repeating obvious nonsense: "Everybody knows a consultant just handed them that line and they're just reading it. It doesn't matter what's in the bill. It could be a bill about breakfast cereal and they're going to say this is a bailout bill."But what was especially interesting this morning was the moment when host Joe Scarborough turned to Time's Mark Halperin, and urged him to "defend the Republican position" on the legislation. Halperin... couldn't.... "I cannot defend what they're doing," Halperin said. "They are willfully misreading the bill or they are engaged in a cynical attempt to keep the president from achieving something."...Mark Halperin is calling [Republicans] out for lying...When even Mark Halperin is calling Republicas out for lying, it is long past time to shut the Republican Party down.

There is no "bailout fund"

Section 210 of Chris Dodd's financial regulation bill (pdf) isn't what you'd call a gripping read. In fact, there's really no part of Dodd's bill that you'd call a gripping read. But Section 210, subsection (n), matters because it explains the workings of the "orderly liquidation fund," that $50 billion pot o' cash that Mitch McConnell and the Republicans have decided to call a "bailout fund."

Here's how the liquidation fund works: A year after the bill is signed, the secretary of the Treasury begins taxing banks based on the risk they pose to the financial system. This tax must raise $50 billion and last for at least five years but no more than 10 years. So first, that's where the fund comes from: a tax on too-big-to-fail banks, which has the added bonus of giving a slight advantage to smaller banks that won't be laboring under this tax.

When it comes to saving failing banks, $50 billion isn't a lot of money. Think of the $700 billion TARP fund. Or even look at the House bill, which has a $150 billion resolution fund. But then, the $50 billion isn't there to save banks. It's there to liquidate them.

Here's the chain of events: A bank is judged failing. The FDIC submits a plan for the bank's liquidation -- which includes firing management, wiping out shareholders, handing losses to creditors, and selling off the firm -- and gets it approved by the Treasury secretary. Then the FDIC takes over the banks. The $50 billion fund is used to keep the lights on while all this happens. It's there to prevent taxpayers from having to foot the bill for the chaos that will occur between when we recognize a bank is failing and when we shut it down.

Whatever you want to call this, it isn't a bailout. It's the death of the company. And the fund is way of forcing too-big-to-fail banks to pay for the execution. But stung by Republican criticisms, the administration is telling Democrats to let the fund go. And they're not all that unhappy to see it die. "The fund isn’t a priority for the Obama administration," reported Business Week, "which instead proposed having the financial industry repay the government for the cost of disassembling a failed firm, an approach preferred by the industry."

So let's just be clear: The alternative to the liquidation fund is Wall Street's preference. That should tell you pretty much all you need to know about whether the industry really views this as a bailout.

On the Senate floor yesterday, Bob Corker, who's been unfailingly respectful of his colleagues' criticisms of the bill, had enough. "This fund that’s been set up is anything but a bailout," he said. "It’s been set up to provide upfront funding by the industry so that when these companies are seized, there’s money available to make payroll and to wind it down while the pieces are being sold off." The only question, Corker said, was whether you pre-fund by taxing the banks, which is what the Republican head of the FDIC wants and the bill does, or whether you post-fund by recouping taxpayer losses after the fact, which the Treasury Department and the industry prefer.

That -- and not bailouts -- is the debate. And by demonizing it, Republicans will force Democrats to retreat to the post-funding structure that was the original preference of both the Obama administration and the financial industry. That's not really a strike against future bailouts, though it might be something you promised a roomful of bankers you'd do on their behalf.